Duties and Taxes Process

Below are examples of the financial process that takes place between European Merchants and both European and Non-European customers,

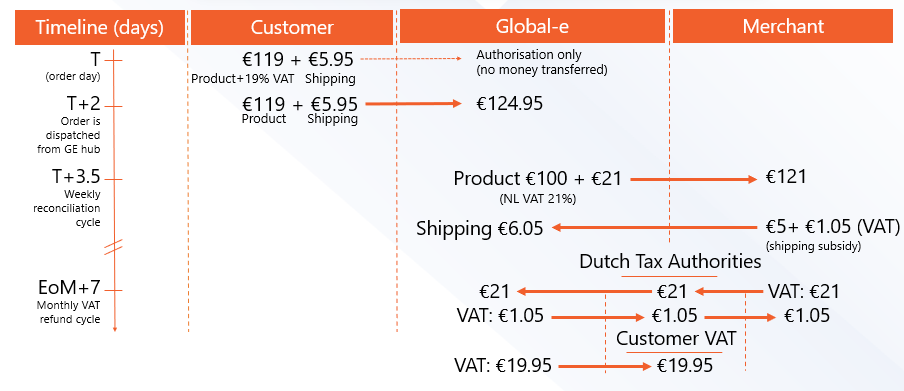

Example: Intra-EU “distance selling” to Germany (VAT = 19%)

EU Merchant – EU Customer

Product price in Europe = €121 (€100 + 21% VAT) - exported into the EU (Germany)

Shipping cost €10 , charged to customer €5 (shipping subsidy €5)

Net product sale for Merchant: €100

Net after shipping subsidy: €95

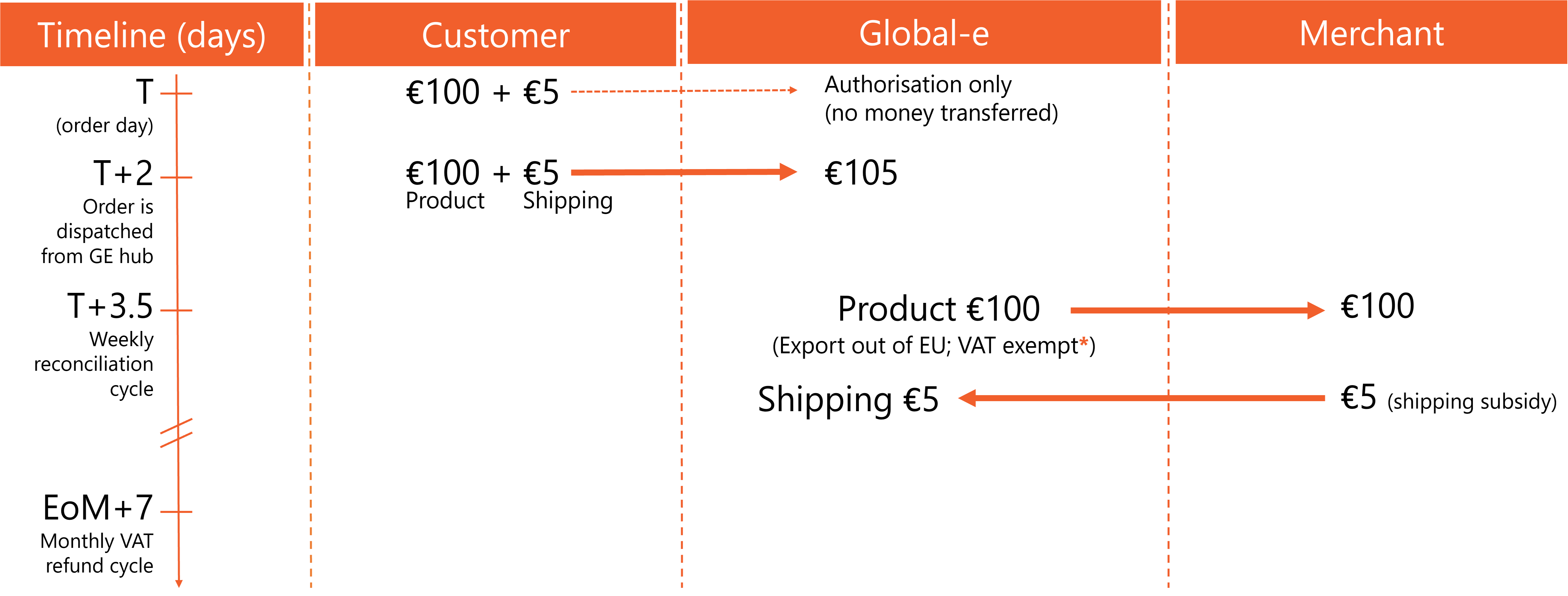

Example: Deduct Dutch VAT outside the EU

Dutch Merchant – Non-EU Customer

Product price in Europe = €121 (€100 + 21% VAT) - exported out of the EU

Shipping cost €10 , charged to customer €5 (shipping subsidy €5)

Net product sale for Merchant: €100

Net after shipping subsidy: €95

Note

While the sale is a domestic sale between two Dutch entities, since the final destination of the goods is outside of the EU, a VAT exemption applies.

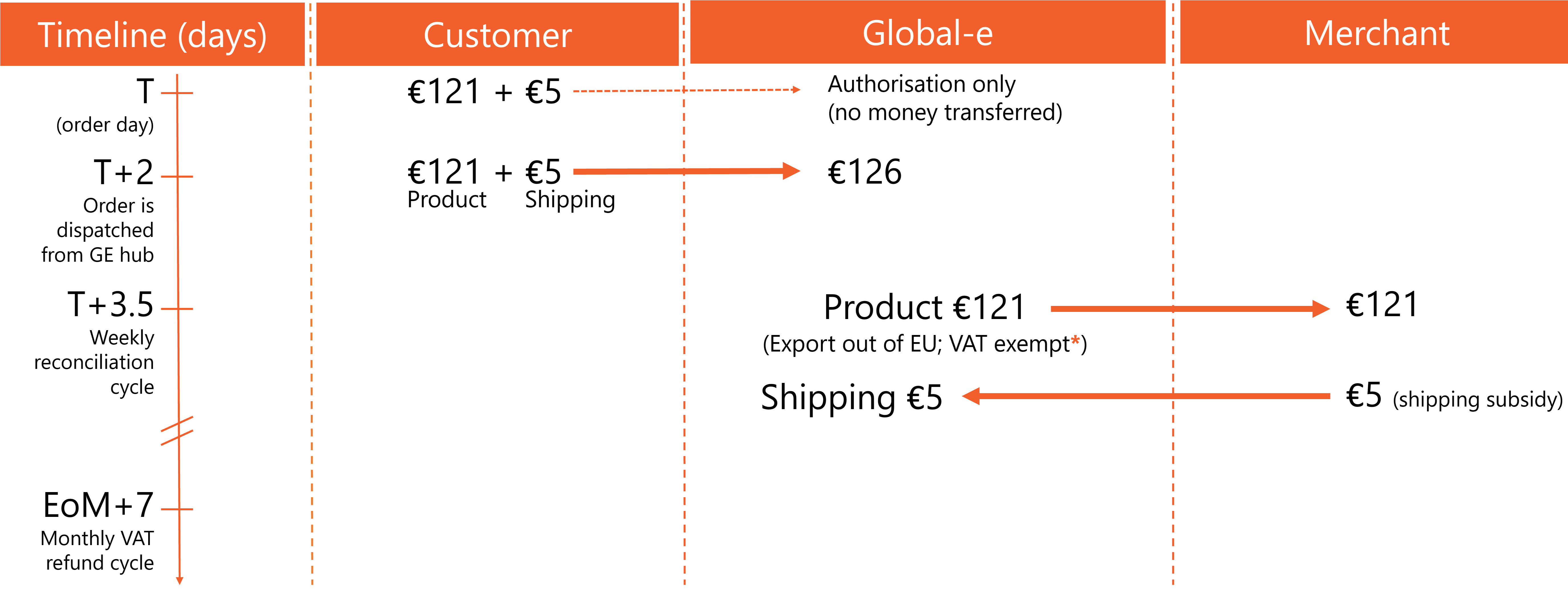

Example: “Pocket” VAT outside the EU

Dutch Merchant – Non-EU Customer

Product price in Europe = €121 (€100 + 21% VAT) - exported out of the EU

Shipping cost €10 , charged to customer €5 (shipping subsidy €5)

Net product sale for Merchant: €121

Net after shipping subsidy: €116

Note

While the sale is a domestic sale between two Dutch entities, since the final destination of the goods is outside of the EU, a VAT exemption applies.