Duties and Taxes Process

Merchants can choose between two methods of collecting duties and taxes from customers:

Optional/Forced DDP: Customers pre-pay duties and taxes at checkout, which are passed by Global-e to the Merchant, and in most cases, passed on to their shipper. However, in some countries, like the US, Global‑e will retain and remit these to the authorities directly.

Hidden Forced DDP: Duties and taxes are built into the amount paid by the end customer. For most countries, Global‑e will pass the full value of the product to the Merchant, including the duties and taxes intended for the shipper. In some countries like Australia, Global‑e will retain and remit these taxes directly to the authorities.

Below are two examples of the financial process that takes place when a non-UK customer purchases from a British Merchant.

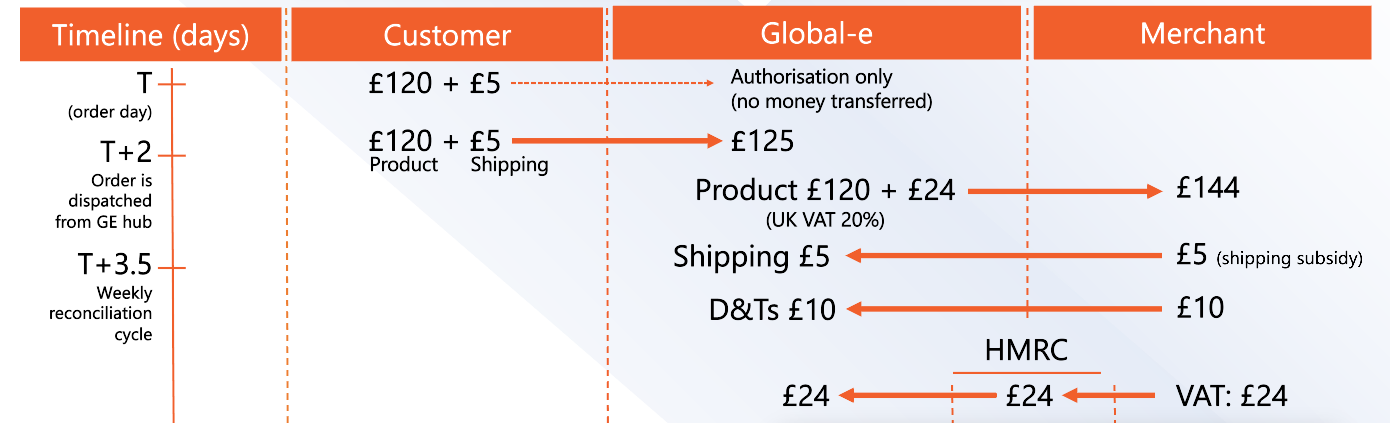

Example: Optional/Forced DDP for Duties & Taxes

British Merchant - Non-UK Customer

Product price in the UK = £120 (£100 + 20% VAT) - exported out of the UK

Shipping cost £10, charged to customer £5 (shipping subsidy £5)

Net product sale for the Merchant: £100

Net after shipping subsidy: £95

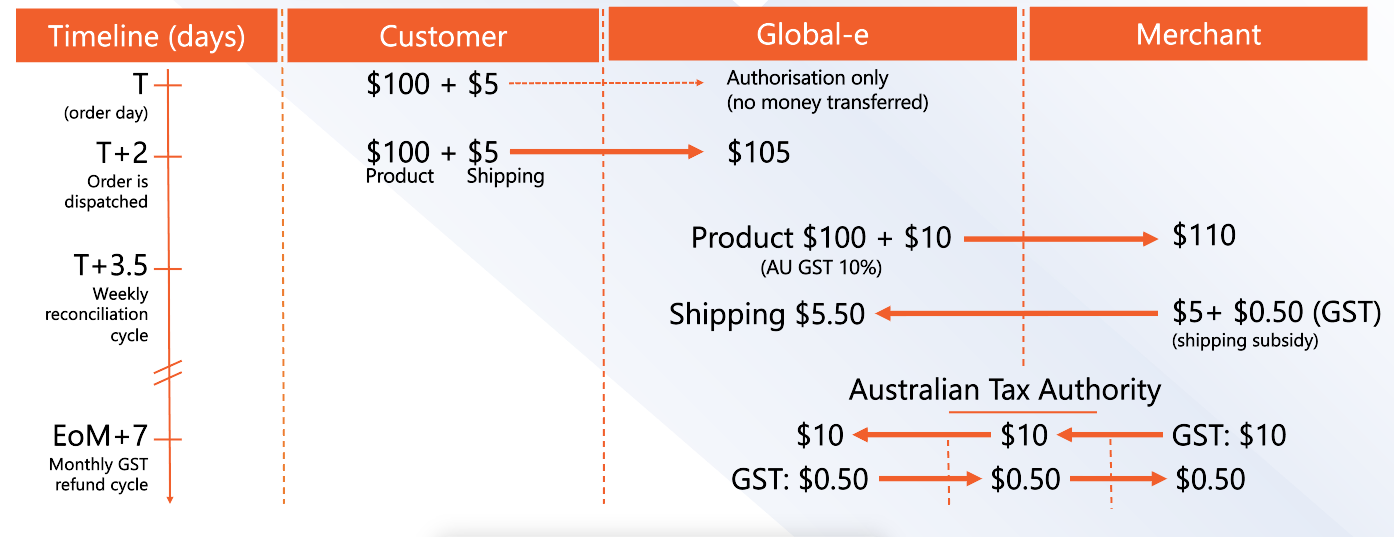

Example: Hidden Forced DDP for Duties & Taxes

British Merchant - Non-UK Customer

Product price in the UK = £120 (£100 + 20% VAT) - exported out of the UK

Shipping cost £10, charged to customer £5 (shipping subsidy £5)

Net product sale for the merchant: £120

Net after shipping subsidy: £105