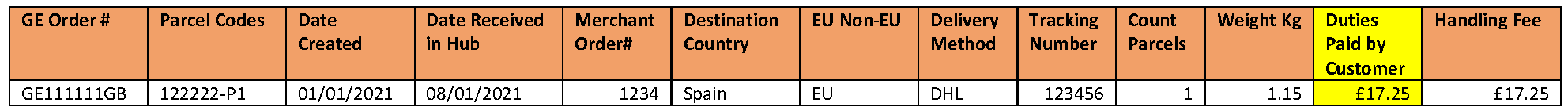

Reconciliation Report > ShippingPerParcel tab: Who is charged for tax subsidization?

When D&T are part of the price, they are deducted from the amount Global-e pays you and we hand them over to the authorities on your behalf.

Important

Usually, this amount does not come out of your pocket since a coefficient is generally added to the country that increases the price of the product.

Example: A UK merchant sells to a Spanish customer.

Arnon, not clear. We talk about Euro but the picture underneath refers to pounds. Is this a mistake?

D&T = 15 % that the customer is required to pay. Therefore, the coefficient that needs to be added is 15%.

The item costs 100 GBP, converted to Euro = ~ 115 Euro.

D&T on this order would be 115 Euro * 15% = 17.25 Euro.

Additional coefficient of 15 % = 115 GBP, converted to Euro = ~ 134 Euro.

Global‑e deducts 17.25 Euro from the 134 Euro, meaning the amount you receive is 134 – 17.25 = 116.75