Duties and Taxes Process

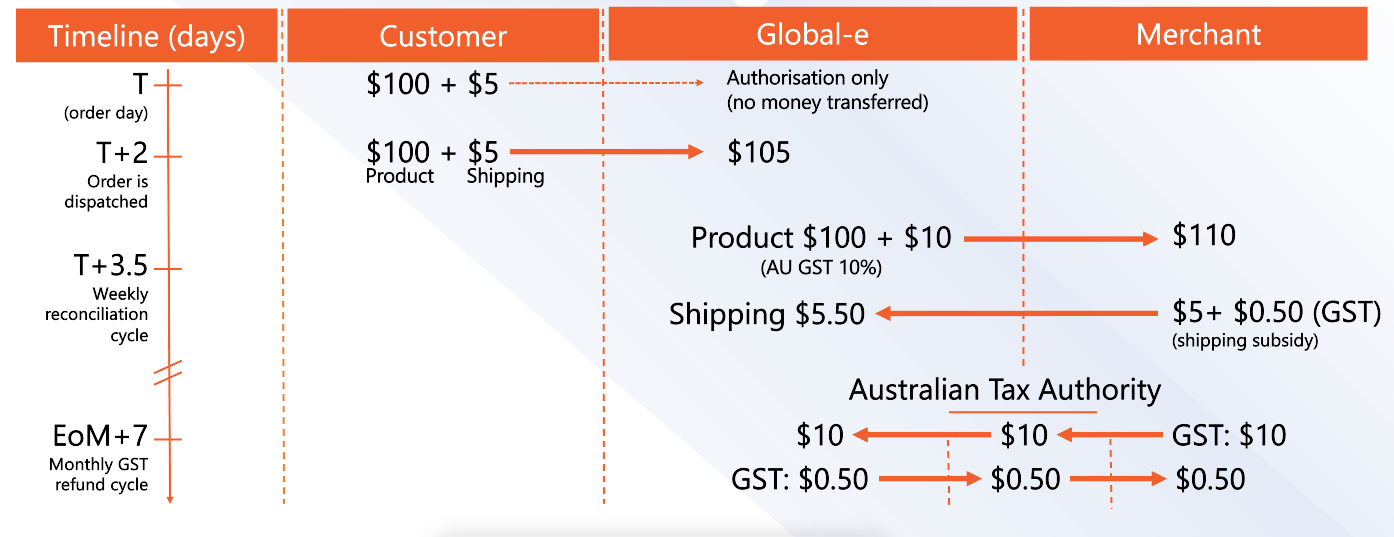

Below is an example of the financial process that takes place when a customer purchases from a Merchant in Australia.

Australian Merchant- GE Australia

Example: Deduct Australian GST

Product price in AUD = $110 ($100 + 10% GST) - exported from Australia

Shipping cost $10, charged to customer $5 (shipping subsidy $5)

Net product sale for the merchant: $100

Net after shipping subsidy: $95