Shipping with Non-Global-e Carriers

Overview

This guide is designed for merchants using their own carrier accounts and integration to ship Global-e orders. It provides the essential guidelines for creating the necessary clearance documents, including shipping labels and commercial invoices.

Key Roles and Responsibilities

The following roles and responsibilities apply:

Merchant of Record (MoR) - Global-e:

Global-e acts as the Merchant of Record (seller) for all orders processed through Global-e. In certain destinations, Global-e is responsible for remitting taxes to local authorities.

The system generating export documents must ensure that Global-e specific information is accurately transferred to carriers during shipment booking and correctly reflected on customs documents.

Exporter of Record (EOR) & Shipper of Record (SOR) - Merchant/Third Party Logistics.

Importer of Record (IOR) – Customer, except in Switzerland, where the Importer of Record is Global-e Switzerland.

Importer of Record (IOR) on Returns – Merchant/Third Party Logistics.

The merchant or Third-Party Logistics acts as the importer of Record and is responsible for managing the return of goods to their country of origin. This includes:

Clearing the goods through customs and ensuring compliance with import regulations.

Applying Returned Goods Relief to qualify for duty exemption where applicable.

Implementation Requirements

The Third Party or system responsible for generating shipping and customs documentation must build custom logic to:

Clear the shipment according to the defined configuration and order model, including using the right incoterm based on whether Duties and/or Taxes are included in the order or must be paid at delivery.

Retrieve and apply the correct product prices for customs from Global-e, ensuring that the declared customs values align with the tax calculation rule model (FOB or CIF) to prevent discrepancies.

Ensure Global-e information is accurately declared to carriers and customs documents whenever required.

Failure to implement these guidelines correctly may result in delays, tax liabilities, compliance and/or customer experience issues.

Integration Flow

There are two possible ways of implementing this model:

Retrieving the required information using Global-e’s

GetOrdersDetailsAPI.Extracting the required information from the platform directly, which can be obtained through “custom attributes” when orders are exported to downstream system (OMS/ERP/WMS).

Preferred Approach

Implementing the GetOrdersDetails API is highly recommended because:

It ensures all required information is up to date and easily accessible.

It reduces dependency on the relevant data having to flow through multiple downstream systems, simplifying the integration process.

Global-e registration details will not be available through platform-based integration and will be instead provided separately in a file. These will need to be pre-configured by the merchant/3PL in their own system.

Implementation of the Solution

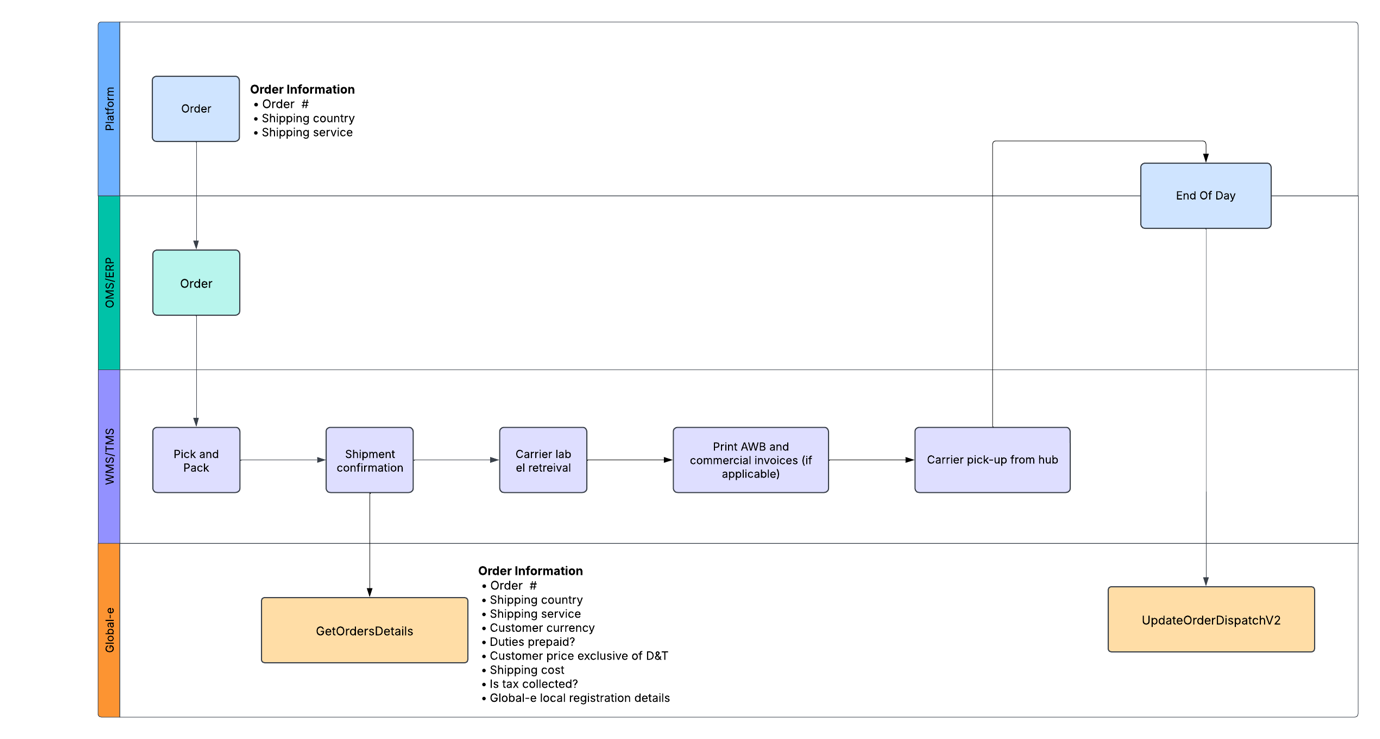

GetOrdersDetails API Workflow

|

API & Environment Details

API Documentation

️ For detailed API specifications, refer to GetOrdersDetails API.

Global-e Environments

Note

Consult your Global-e project team to determine the appropriate environments for your integration.

Environment | URL Endpoint |

|---|---|

INT (Integration) | https://connect.bglobale.com/ |

STG (Staging) | https://connect2.bglobale.com/ |

PROD (Production) | https://api.global-e.com/ |

Field Mappings

The API method return a list of order details. In the context of producing shipping documentation, the below fields and associated logic must be considered:

Exporter details | Should remain the same as today, i.e. the brand, 3PL, or other relevant party |

Global-e local tax registration | In specific destinations, such as Norway, the UK, the EU (Cross-border), Switzerland, Australia, New Zealand, Singapore, and Malaysia (the exact list of applicable countries will be confirmed during the project), Global-e is responsible for remitting taxes to local authorities. For orders below the threshold, Global-e’s local tax registration must be included on the commercial invoice and declared to the carrier, as Global-e will handle the direct filing of applicable taxes with the respective local authorities. Merchant.Order.ExporterDetails.LocalRegistrationClearance – A Boolean value indicating whether Global-e will remit the tax locally for the order. If TRUE, the following fields must be considered:

️ Important Note: Global-e’s IOSS number must NOT be displayed on the Commercial Invoices |

Importer and import type mention | If (Merchant.ImporterDetails.ImporterType = 0) “Private Import Mention” for B2C shipment - Merchant.Order.ImportDetails.CustomerTaxId - Customer Tax number provided at checkout as required for clearance into certain markets (eg. Brazil, Turkey) If (Merchant.ImporterDetails.ImporterType = 1) Importer details should have the Mention "Business Importer" – only applicable for shipments to Switzerland. - Merchant.Order.ImporterDetails.Company –Global-e importer entity name for relevant markets (e.g. Switzerland) - Merchant.Order.ImporterDetails.VATRegistrationNumber - Global-e importer entity registration number for relevant markets (e.g. Switzerland) - Merchant.Order.ImporterDetails.Address - Global-e Importer entity |

Shipper name/address | Should remain the same as today, e.g. the brand, 3PL, or other relevant party |

Currency | Merchant.Order.InternationalDetails.CurrencyCode |

Incoterm | If shipping country = “Switzerland” Shipment to be cleared under Global-e’s ZAZ account / "Terms of Delivery" to be decided with carrier ️ Important Note: Only the taxes applicable to the clearance into Switzerland should be billed against Global-e’s ZAZ account. Any other fee charged by the carrier in relation to the clearance should be billed to the Shipper of Record (brand/3PL) Merchant.Order.InternationalDetails.DutiesGuaranteed : true Shipment to be cleared as DDP or equivalent incoterm, to ensure no additional Duties and/or Taxes are requested to be paid at delivery by the customer. If "Merchant.Order.InternationalDetails.DutiesGuaranteed" : false and "Merchant.Order.ExporterDetails.LocalRegistrationClearance” : false Shipment to be cleared as DAP or equivalent incoterm, with applicable Duties and/or Taxes paid at delivery by the customer. If "Merchant.Order.InternationalDetails.DutiesGuaranteed" : false and "Merchant.Order.ExporterDetails.LocalRegistrationClearance” : true Global-e’s local tax registration to be provided to the carrier and presented on the clearance documents, considering that taxes will be filled by Global-e in the destination country (as mentioned in section “Global-e local tax registration number”) Shipment booking to be done following carrier requirements (process to be aligned by the brand with carrier) |

Products | <List> Merchant.Order.Products |

· COO | n/a – to be taken from own systems |

· HS Code | n/a – to be taken from own systems |

Price exclusive of D&T | Merchant.Order.Products[i].InternationalDiscountedPriceForCustoms |

Shipping Cost | Merchant.Order.InternationalDetails.DiscountedShippingPrice |

Destination Tax calculation rule | Merchant.Order.TaxCalculationRule - determines how duties and taxes are calculated for an order. Possible values: CIF (Cost, Insurance, and Freight): This method calculates duties and taxes based on the total cost of goods, including insurance and freight charges. FOB (Free on Board): This method calculates duties and taxes based only on the value of the goods Tax calculation rules defined per country in Global-e system. Clearance documents to be aligned accordingly. |

Total shipment declarative value for customs | Merchant.Order.TotalValueForCustoms |

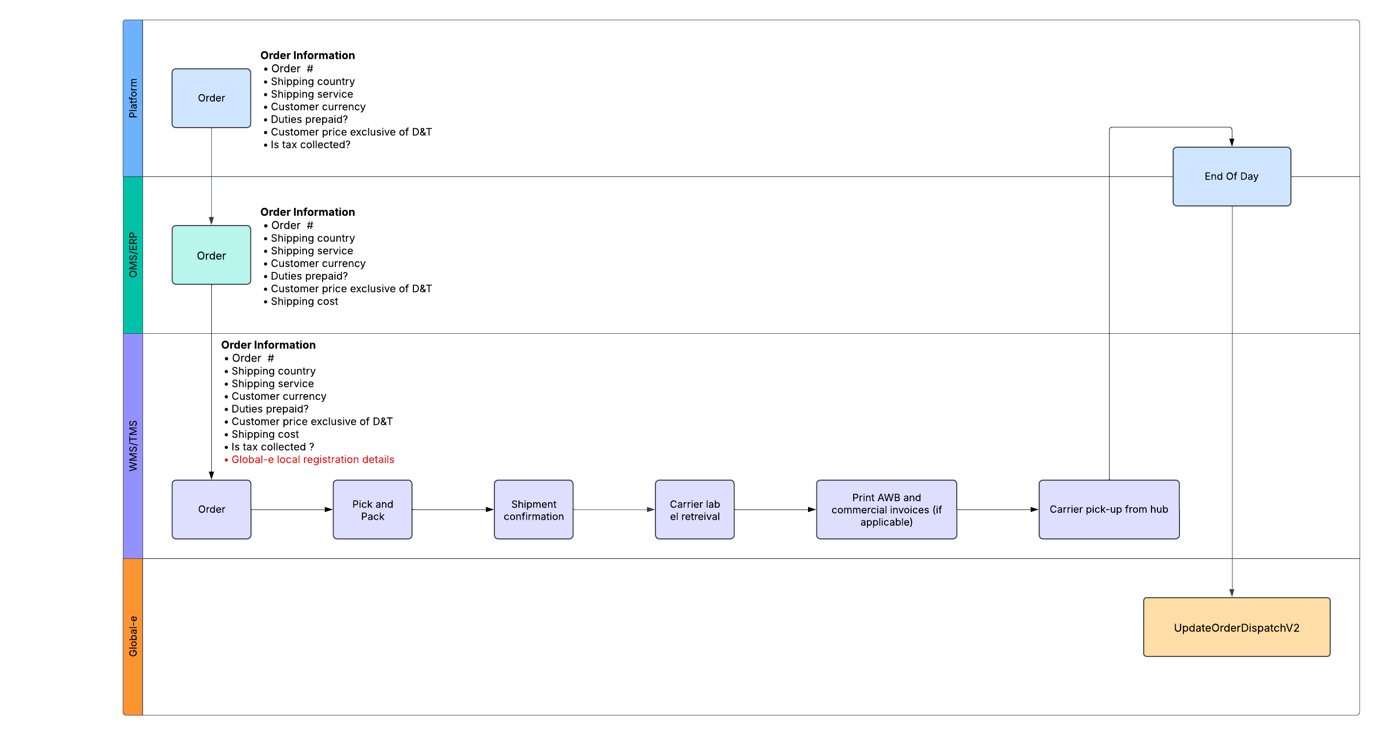

Platform Mapping

|

SFCC Mapping

Exporter details | Should remain the same as today, e.g. the brand, third party logistics (3PL), or other relevant party |

Global-e Local registration details | In specific destinations, such as Norway, the UK, the EU (Cross-border), Switzerland, Australia, New Zealand, Singapore, and Malaysia (the exact list of applicable countries will be confirmed during the project), Global-e is responsible for remitting taxes to local authorities. For orders below the threshold, Global-e’s local tax registration must be included on the commercial invoice and declared to the carrier, as Global-e will handle the direct filing of applicable taxes with the respective local authorities. The relevant details for each destination will be provided separately to allow for it to be stored in the relevant system as part of the integration. ️ Important Note: Global-e’s IOSS number must NOT be displayed on the Commercial Invoices To determine when Global-e local registration details need to be declared, use the below field: geLocalRegistrationClearance – A Boolean value indicating whether the order is tax collected. |

Importer and import type mention | If (shipping country != Switzerland) “Private Import Mention” for B2C shipment geCustomerTaxId - Customer Tax number provided at checkout as required for clearance into certain markets (eg. Brazil, Turkey) Else Importer details should have the Mention "Business Importer" Importer details to Switzerland will be communicated in separate file |

Shipper name/address | Should remain the same as today, i.e. the brand, 3PL, or other relevant party |

Currency | geCustomerCurrencyCode |

Incoterm | If shipping country = “Switzerland” Shipment to be cleared under Global-e’s ZAZ account / "Terms of Delivery" to be decided with carrier ️ Important Note: Only the taxes applicable to the clearance into Switzerland should be billed against Global-e’s ZAZ account. Any other fee charged by the carrier in relation to the clearance should be billed to the Shipper of Record (brand/3PL) If geDutiesGuaranteed: true Shipment to be cleared as DDP or equivalent incoterm, to ensure no additional Duties and/or Taxes are requested to be paid at delivery by the customer. If geDutiesGuaranteed: false and geLocalRegistrationClearance: false Shipment to be cleared as DAP or equivalent incoterm, with applicable Duties and/or Taxes paid at delivery by the customer. If geDutiesGuaranteed: false and geLocalRegistrationClearance: true Global-e’s local tax registration to be provided to the carrier and presented on the clearance documents, considering that taxes will be filled by Global-e in the destination country (as mentioned in section “Global-e local tax registration number”) Shipment booking to be done following carrier requirements (process to be aligned by the brand with carrier) |

Products | <product-lineitem> data from SFCC order record |

· COO | n/a – to be taken from own systems |

· HS Code | n/a – to be taken from own systems |

Price exclusive of D&T | geInternationalDiscountedPriceForCustoms |

Shipping Cost | geTotalDiscountedShippingPrice |

Destination Tax calculation rule | geTaxCalculationRule - determines how duties and taxes are calculated for an order. Possible values: CIF (Cost, Insurance, and Freight): This method calculates duties and taxes based on the total cost of goods, including insurance and freight charges. FOB (Free on Board): This method calculates duties and taxes based only on the value of the goods Tax calculation rules defined per country in Global-e system. Clearance documents to be aligned accordingly. |

Total shipment declarative value for customs | geTotalValueForCustoms |

Shopify Mapping

For brands/third party logistics (3PLs) relying on the Shopify data to create the shipping documents related to Global-e orders, most of the additional information required is made available through the Shopify note_attributes, as detailed in the table below.

Important

While for standard orders, the required note_attributes will be added prior to the Shopify order status being updating to PAID (typically acting as the trigger for export), please note that for orders where no payment is taken (e.g. influencer orders, replacements), or those paid via Gift Cards, the additional data will only be added after the order is marked as PAID, requiring specific logic to be built as part of the order export process.

Exporter details | Should remain the same as today, i.e. the brand, 3PL, or other relevant party |

Global-e Local registration details | In specific destinations, such as Norway, the UK, the EU (Cross-border), Switzerland, Australia, New Zealand, Singapore, and Malaysia (the exact list of applicable countries will be confirmed during the project), Global-e is responsible for remitting taxes to local authorities. For orders below the threshold, Global-e’s local tax registration must be included on the commercial invoice and declared to the carrier, as Global-e will handle the direct filing of applicable taxes with the respective local authorities. The relevant details for each destination will be provided separately to allow for it to be stored in the relevant system as part of the integration. ️ Important Note: Global-e’s IOSS number must NOT be displayed on the Commercial Invoices To determine when Global-e local registration details need to be declared, use the below field: order.note_attributes [LocalRegistrationClearance] – A Boolean value indicating whether the order is tax collected. |

Importer and import type mention | If (shipping country != Switzerland) “Private Import Mention” for B2C shipment Else Importer details should have the Mention "Business Importer" Importer details to Switzerland will be communicated in separate file |

Shipper name/address | Should remain the same as today, i.e. the brand, 3PL, or other relevant party |

Currency | order.presentment_currency |

Incoterm | If shipping country = “Switzerland” Shipment to be cleared under Global-e’s ZAZ account / "Terms of Delivery" to be decided with carrier ️ Important Note: Only the taxes applicable to the clearance into Switzerland should be billed against Global-e’s ZAZ account. Any other fee charged by the carrier in relation to the clearance should be billed to the Shipper of Record (brand/3PL) If order.note_attributes: [ { name: "DutiesPrePaid", value: "true" } Shipment to be cleared as DDP or equivalent incoterm, to ensure no additional Duties and/or Taxes are requested to be paid at delivery by the customer. If order.note_attributes: [ { name: "DutiesPrePaid", value: "false" } and order.note_attributes: [ { name: "LocalRegistrationClearance", value: "false" } Shipment to be cleared as DAP or equivalent incoterm, with applicable Duties and/or Taxes paid at delivery by the customer. If order.note_attributes: [ { name: "DutiesPrePaid", value: "false" } and order.note_attributes: [ { name: "LocalRegistrationClearance", value: "true" } Global-e’s local tax registration to be provided to the carrier and presented on the clearance documents, considering that taxes will be filled by Global-e in the destination country (as mentioned in section “Global-e local tax registration number”) Shipment booking to be done following carrier requirements (process to be aligned by the brand with carrier) |

Products | order.line_items |

· COO | n/a – to be taken from own systems |

· HS Code | n/a – to be taken from own systems |

Price exclusive of D&T | order.note_attributes [ InternationalOrderProductsForCustoms ] |

Shipping Cost | order.note_attributes [DiscountedShippingPrice] |

Destination Tax calculation rule | order.note_attributes [TaxCalculationRule] - determines how duties and taxes are calculated for an order. Possible values: CIF (Cost, Insurance, and Freight): This method calculates duties and taxes based on the total cost of goods, including insurance and freight charges. FOB (Free on Board): This method calculates duties and taxes based only on the value of the goods Tax calculation rules defined per country in Global-e system. Clearance documents to be aligned accordingly. |

Total shipment declarative value for customs | order.note_attributes [TotalValueForCustoms] |

GEM Mapping

Exporter details | Should remain the same as today, i.e. the brand, third party logistics, or other relevant party |

Global-e Local registration details | In specific destinations, such as Norway, the UK, the EU (Cross-border), Switzerland, Australia, New Zealand, Singapore, and Malaysia (the exact list of applicable countries will be confirmed during the project), Global-e is responsible for remitting taxes to local authorities. For orders below the threshold, Global-e’s local tax registration must be included on the commercial invoice and declared to the carrier, as Global-e will handle the direct filing of applicable taxes with the respective local authorities. The relevant details for each destination will be provided separately to allow for it to be stored in the relevant system as part of the integration. ️ Important Note: Global-e’s IOSS number must NOT be displayed on the Commercial Invoices To determine when Global-e local registration details need to be declared, use the below field: Merchant.Order.ExporterDetails.LocalRegistrationClearance – A Boolean value indicating whether the order is tax collected. |

Importer and import type mention | If (Merchant.ImporterDetails.ImporterType = 0) “Private Import Mention” for B2C shipment Merchant.Order.ImportDetails.CustomerTaxId - Customer Tax number provided at checkout as required for clearance into certain markets (eg. Brazil, Turkey) If (Merchant.ImporterDetails.ImporterType = 1) Importer details should have the Mention "Business Importer" Importer details to Switzerland will be communicated in separate file |

Shipper name/address | Should remain the same as today, i.e. the brand, 3PL, or other relevant party |

Currency | Merchant.Order.InternationalDetails.CurrencyCode |

Incoterm | If shipping country = “Switzerland” Shipment to be cleared under Global-e’s ZAZ account / "Terms of Delivery" to be decided with carrier ️ Important Note: Only the taxes applicable to the clearance into Switzerland should be billed against Global-e’s ZAZ account. Any other fee charged by the carrier in relation to the clearance should be billed to the Shipper of Record (brand/3PL) CautionOnly the taxes applicable to the clearance into Switzerland should be billed against Global-e’s ZAZ account. Any other fee charged by the carrier in relation to the clearance should be billed to the Shipper of Record (brand/Third Party Logistics). Merchant.Order.InternationalDetails.DutiesGuaranteed : true Shipment to be cleared as DDP or equivalent incoterm, to ensure no additional Duties and/or Taxes are requested to be paid at delivery by the customer. if "Merchant.Order.InternationalDetails.DutiesGuaranteed": false and "Merchant.Order.ExporterDetails.LocalRegistrationClearance”: false Shipment to be cleared as DAP or equivalent incoterm, with applicable Duties and/or Taxes paid at delivery by the customer. if "Merchant.Order.InternationalDetails.DutiesGuaranteed": false and "Merchant.Order.ExporterDetails.LocalRegistrationClearance”: true Global-e’s local tax registration to be provided to the carrier and presented on the clearance documents, considering that taxes will be filled by Global-e in the destination country (as mentioned in section “Global-e local tax registration number”) Shipment booking to be done following carrier requirements (process to be aligned by the brand with carrier) |

Products | <List> Merchant.Order.Products |

· COO | n/a – to be taken from own systems |

· HS Code | n/a – to be taken from own systems |

Price exclusive of D&T | Merchant.Order.Products[i].InternationalDiscountedPriceForCustoms |

Shipping Cost | Merchant.Order.InternationalDetails.DiscountedShippingPrice |

Destination Tax calculation rule | Merchant.Order.TaxCalculationRule - determines how duties and taxes are calculated for an order. Possible values: CIF (Cost, Insurance, and Freight): This method calculates duties and taxes based on the total cost of goods, including insurance and freight charges. FOB (Free on Board): This method calculates duties and taxes based only on the value of the goods Tax calculation rules defined per country in Global-e system. Clearance documents to be aligned accordingly. |

Total shipment declarative value for customs | Merchant.Order.TotalValueForCustoms |

Special Destination Cases

Important

Please note that the commercial invoice examples below are for illustration purpose only, with the sole purpose to highlight the fields required for the given destination country. It does not, in any case, recommend using this specific format.

Global-e is not providing guidance on the invoice format but only specifying the necessary fields to ensure the correct processing of the shipment. This example is for reference only. The 3PL or system generating the invoice should rely on their existing templates.

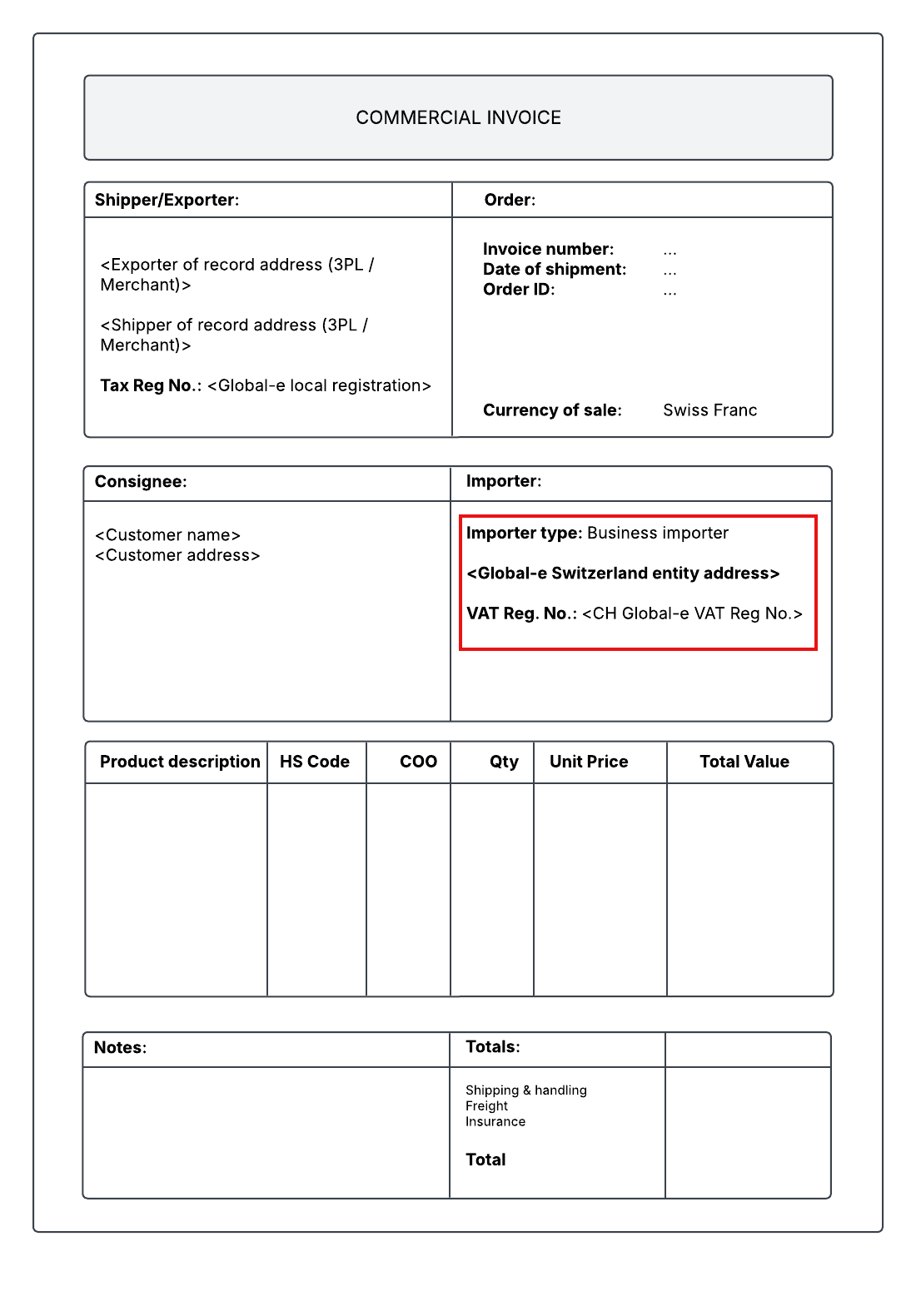

Switzerland

Shipments to Switzerland should be handled as business import and cleared using Global-e’s ZAZ account.

It is important for the merchant/3PL to confirm whether the selected carriers into Switzerland support delivery as Business Import, as not all carriers accommodate this model and if they can clear goods with a ZAZ account.

The invoice’s sold to party (not the consignee) must be Global-E’s name and include Global-E’s local VAT registration number – Terms of Delivery to be decided with carrier.

Caution

Global-e’s ZAZ account number must NOT be displayed on the Commercial Invoices. Also, only the taxes applicable to the clearance into Switzerland should be billed against Global-e’s ZAZ account. Any other fee charged by the carrier in relation to the clearance should be billed to the Shipper of Record (brand/3PL) and NOT Global-e’s ZAZ account.

Example: Order to Switzerland

|

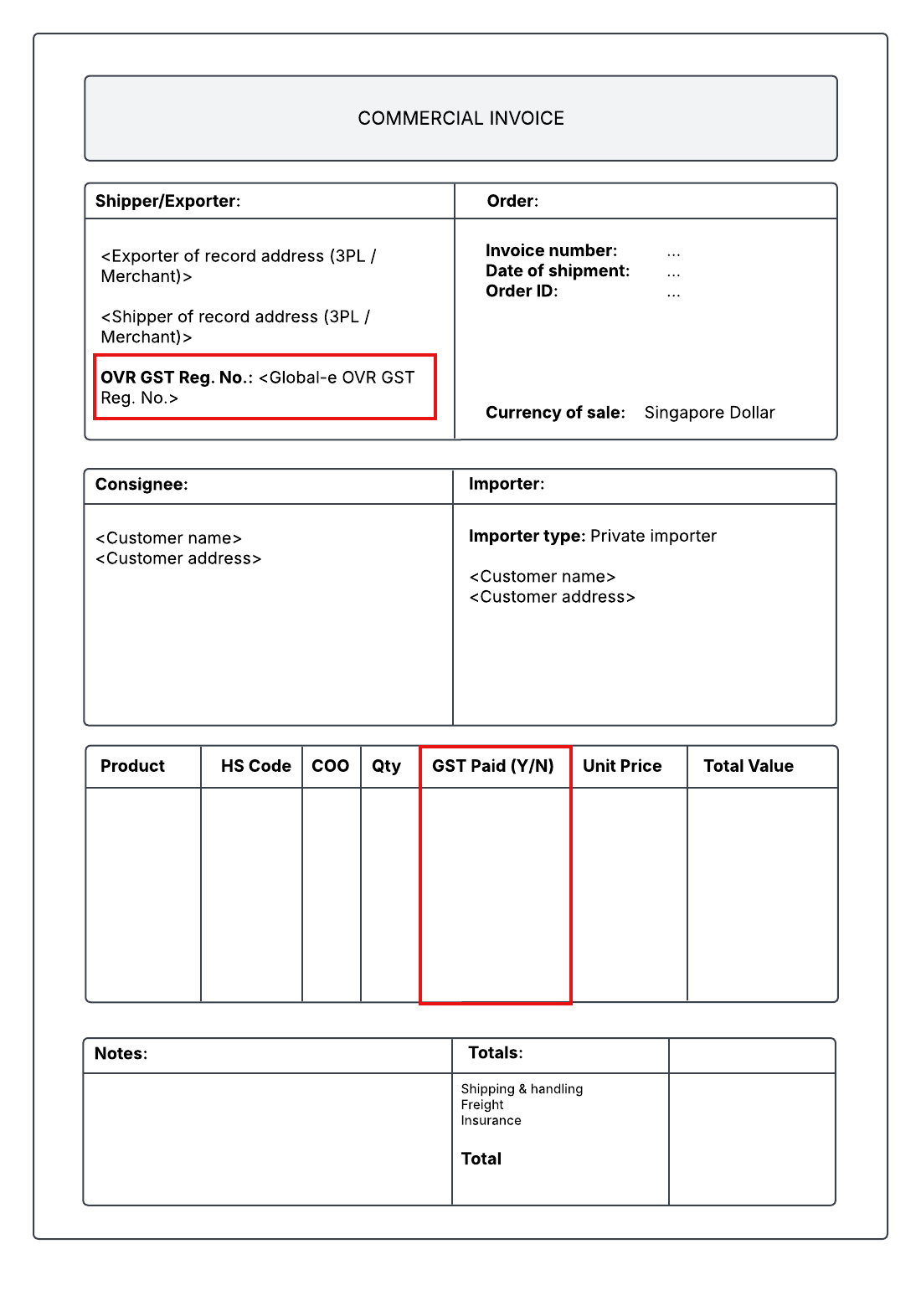

Singapore

In compliance with Singaporean regulations, the commercial invoice should include the following elements:

OVR GST Number

GST payment indication for each line item:

“Y”, for orders below the threshold (SGD 400), taxes are paid by Global-E to the authorities.

“N”, for orders above the threshold (SGD 400), taxes are paid by the Shipper upon import.

Example: Order to Singapore

|

Malaysia

In accordance with Malaysian regulations, the commercial invoice should include the LRN Number.

Tax application rules in Malaysia are as below:

Orders Below 500 MYR: Full Tax Remitted: Global-e will handle tax remittance to the authorities.

Orders Above 500 MYR: Partial Tax Remitted:

If each product is individually priced below 500 MYR: Tax will be remitted to the authorities by Global-e. Duties will be collected at the border by the carrier.

If the order includes products both above and below 500 MYR: Tax for products below 500 MYR will be remitted to the authorities by Global-e. Duties will be collected at the border by the carrier.

If each product is individually priced above 500 MYR: Both duties and taxes will be collected at the border by the carrier