Duties and Taxes on the Checkout Page

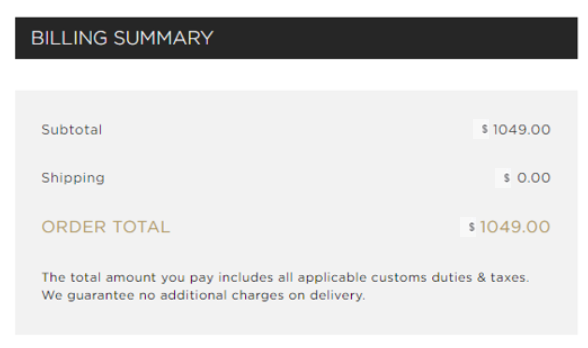

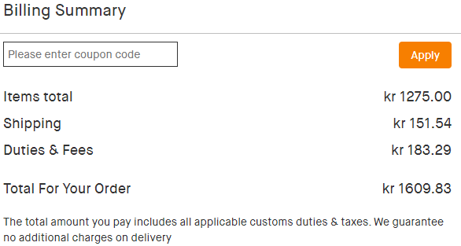

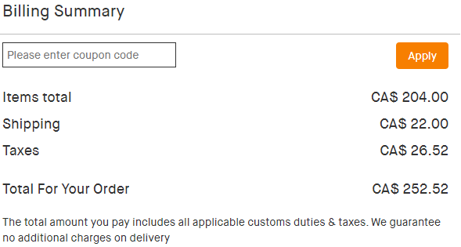

Global-e calculates the duties and taxes due for each relevant order. If there is an option to pay them in advance, it displays them to the customer on the checkout page. Paying in advance guarantees no additional costs on delivery.

The option of charging the D&T depends on the Merchant.

DDP (Delivered Duty Paid) - Import D&T is handled, guaranteed, and paid at the point of sale (i.e. checkout). No additional charges apply to the customer on receiving the parcel.

DDU (Delivered Duty Unpaid) - Import D&T is not paid for before arriving in the destination country. It is paid by the customer when the products arrive at the destination.

Hidden Force DDP (HFDDP) - A method in which the D&T is hidden in the product price. The Merchant can uplift the product prices using the Country Price Coefficient to cover the D&T, taking into consideration the Country threshold and D&T Rates. From the buyer's point of view, the product price includes D&T – so it is a DDP order.

Partial Force DDP (PFDDP) - Either the duties or taxes are included in the total price displayed on the checkout page.

The shipper is notified if the parcel is DDP or DDU, as an indication of who should be charged.

In the reconciliation between Global-e and the Merchant, the D&T charges are applied to the Merchant.