VAT Calculation

B2B VAT

Businesses that sell goods to customers in other countries are obligated to charge and collect local consumption taxes. The EU has enacted distance selling regulations to encourage free trade in the EU.

As part of Global-e’s services, and since we are the merchant on record for all your cross-border transactions, we take responsibility for the VAT registration in each EU country. We also calculate the relevant VAT rate on each of your EU transactions and apply the correct VAT for each case. If you sell products that qualify for reduced VAT, we work with you during onboarding to identify the relevant products on your website, so that the correct VAT rate can be applied.

How it works:

For each Global-e transaction, Global-e, as the merchant on record, purchases the items from the Merchant.

The product is purchased from the Merchant by the associated Global-e entity of the Merchant (i.e. Global-e UK purchases for UK merchants, Global-e US for US merchants, etc.) The purchase is like a domestic transaction between the Merchant and one of its domestic buyers.

For a purchase from a UK Merchant, Global-e also has to pay the UK VAT, similar to any UK buyer purchasing from a UK Merchant. Global-e then claims back the UK VAT from the UK authorities.

Global-e also provides additional services to the UK Merchant, such as shipping, fraud checks, and payment processing. The UK Merchant purchases these services from Global-e and additional domestic VAT is added. The UK Merchant then claims the local VAT back from the UK authorities.

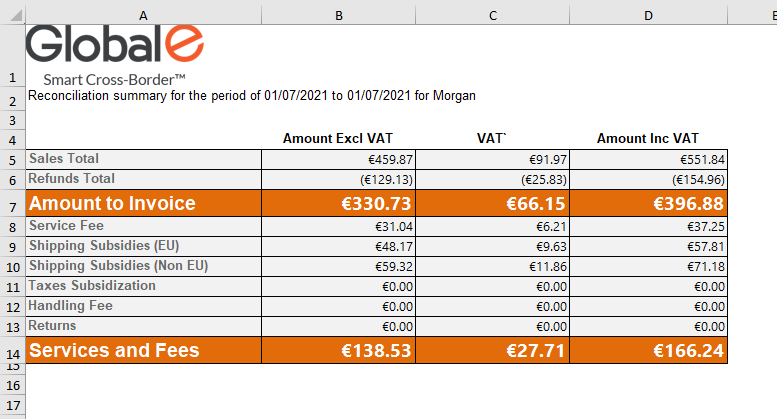

The Reconciliation Report describes all the Products and Services provided during a transaction between Global-e and the Merchant. The UK VAT paid to the Merchant is included under Products and the UK VAT paid by the Merchant to Global-e is under Services.

Products subject to a reduced VAT

Several EU countries apply reduced VAT rates to specific products. For example, children’s clothing and books are subject to 0% VAT in the Republic of Ireland.

Global-e works with you during the onboarding phase to identify these products and collect the required information so that we can accurately calculate their VAT rates.

If this process has not been done during onboarding, please contact customer service to identify your products subject to reduced VAT rates and update accordingly.