US Merchants with Non-Global-e Carriers

When an international customer visits your site, Global‑e converts the price of your product to the customer's currency.

At checkout, the customer is presented with the financial details of the transaction:

The price of the product minus discounts

Shipping

Duties and taxes

After verifying the validity of the transaction, Global‑e collects the payment and the order is packed and shipped.

If you are shipping the products directly from your hub then the final title transfer takes place in the origin country, making this a domestic B2B sale.

If you are shipping from a Global-e hub, the final title transfer occurs when the goods arrive at the domestic Global-e hub.

Global‑e then converts the amount of the sale back to your currency and refunds you the amount of the sale, deducting relevant fees and subsidies.

If you are using your own carriers then the shipping fee, plus duties and taxes (if paid for by the carrier), are included in the refund.

Duties and Taxes Process

Merchants can choose between two methods of collecting duties and taxes from customers:

Optional/Forced DDP : Customers pre-pay duties and taxes at checkout, which are passed by Global-e to the Merchant, and in most cases passed on to their shipper. However in some countries, like the US, Global-e will retain and remit these to the authorities directly.

Hidden Forced DDP : Duties and taxes are built into the amount paid by the end customer. For most countries, Global-e will pass the full value of the product to the Merchant, including the duties and taxes intended for the shipper. In some countries like Australia, Global-e will retain and remit these taxes directly to the authorities.

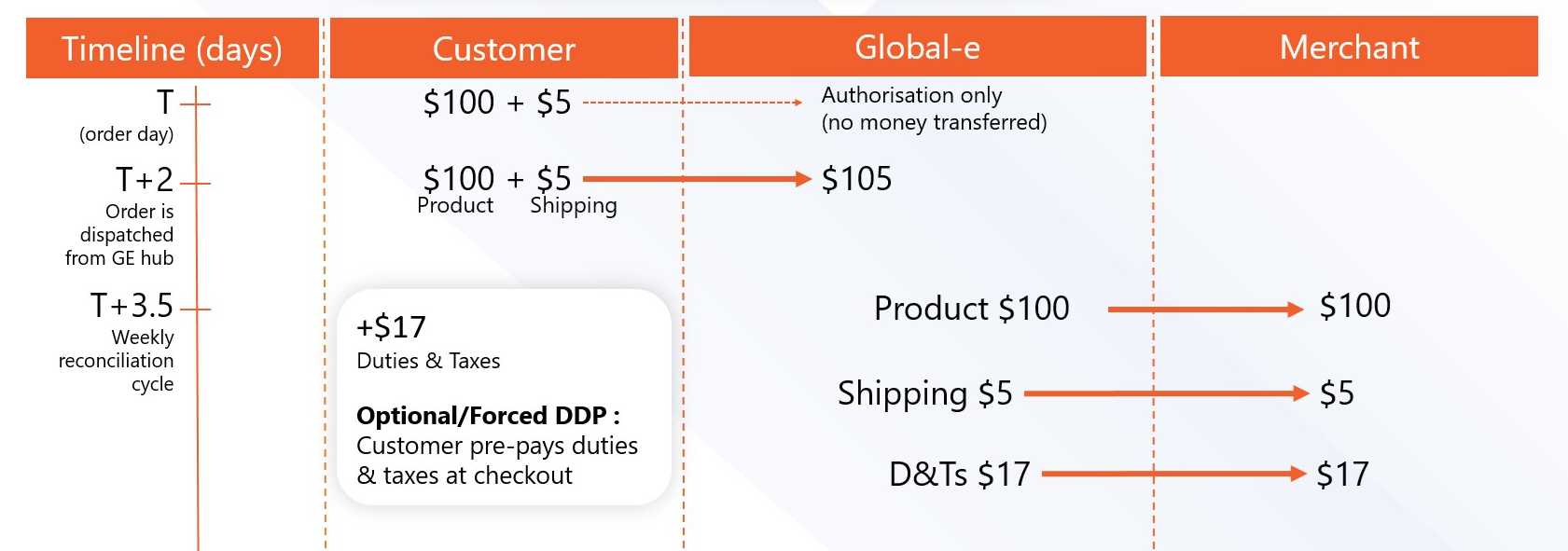

Below are two examples of the financial process that takes place when a customer outside the US purchases from a US Merchant.

Example: Optional/Forced DDP for Duties and Taxes

US Merchant – Israeli Customer

Product price in USD = $100 - exported to Israel

Shipping cost charged to customer $5

Net product sale for Merchant: $100

Net after shipping subsidy: $122

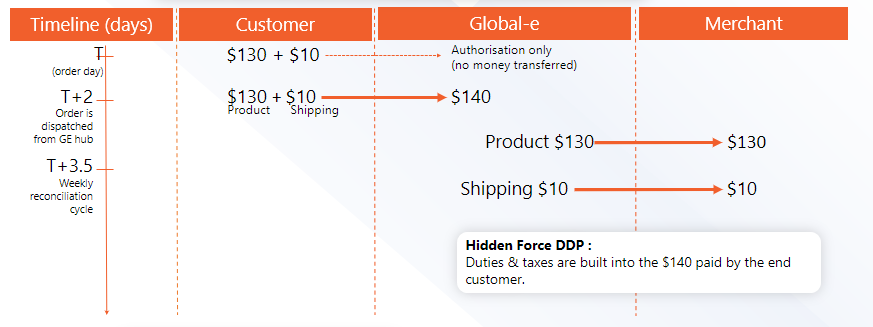

Example: Hidden Forced DDP for Duties and Taxes

US Merchant – EU Customer

Product price in USD = $100 + 30% Country Coefficient – exported to EU

Shipping cost charged to customer $10 (incl. 10% GST)

This process is also used for Switzerland, the UK, New Zealand, and Norway

Net product sale for Merchant: $130

Net after shipping subsidy: $140

Billing Period and Payment Term

The reconciliation process typically takes place on a weekly basis and results in a comprehensive report of all Merchant sales for the week.

Based on the report, Global-e pays the Merchant the sum of all products sold internationally during that week plus any relevant shipping, duties, and taxes, minus the agreed service fee.

Global-e's standard payment terms:

Merchant invoice or a Global-e credit note for sales minus refunds.

Payment within two days from the date of reconciliation.

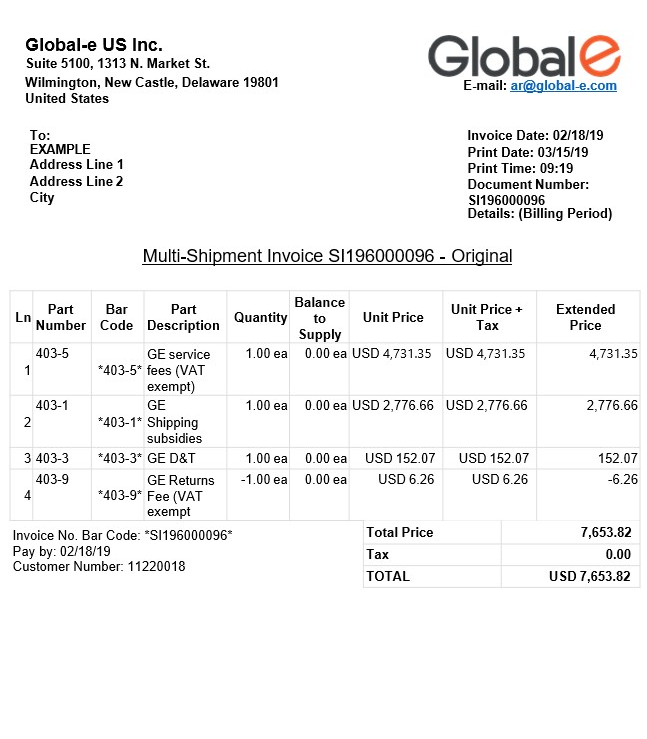

Invoicing

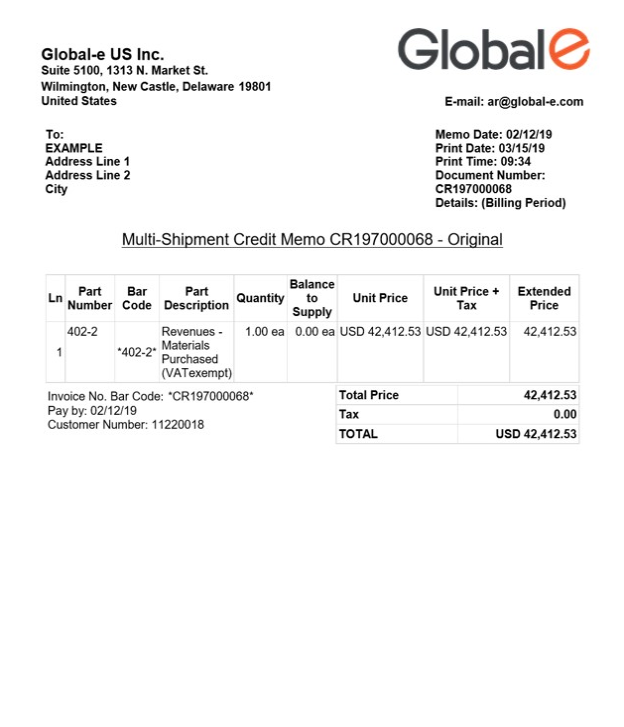

When the Reconciliation Report is generated, Global-e also provides Merchants with two invoices:

A self-billing invoice for sales-less refunds.

An invoice for Global-e’s services, fees, and any shipping subsidies.

To view the invoice go to the Global-e Merchant Portal > Merchants > Reports > Reconciliation Reports.

Global-e’s Invoice for Services and Fee

Credit note for Net Sale

Global-e Purchase Example

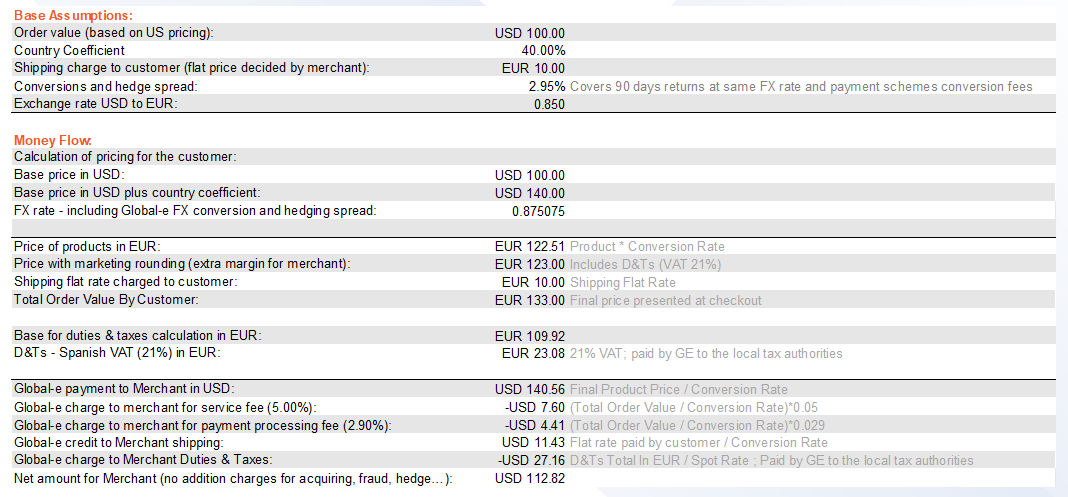

The following purchase example offers a detailed look at the price conversion process.

US Merchant- Spanish Customer

Reconciliation Report Example - US Merchants with Non-Global-e Carriers

Below is a sample Reconciliation Report with a breakdown of the services and fees for that week.

For a list of all the report fields and their definitions, see Reconciliation Report.

For a video describing the Reconciliation Report, see Video Overviews: Financial Flow & Weekly Reconciliation Report.

Amount Exc. VAT | ||

|---|---|---|

Sales Total | $54993.70 | |

Refunds Total | ($12581.17) | |

Amount to Invoice | $42412.53 | |

Service Fee | $4731.35 | 7.0% of Total Order Value |

Payment Processing Fee | $0.00 | |

Service Fee Adjustment | $0.00 | |

Shipping Subsidies | $2776.66 | |

Taxes Subsidization | $152.07 | |

Handling Fee | $0.00 | |

Returns | ($6.26) | |

Services and Fees | $7653.82 |

Sales Total

Order Level

Sales Total on the Order Level

Product Level

Sales total on the Product Level

Refunds Total

Lists all the refunds that were issued through Global‑e during the relevant period

Shipping Subsidies

Shipping prices are based on the actual weight that we received from the shipper or measured at our hub

Returns

Includes the details of each returned parcel

Video Overviews: Financial Flow & Weekly Reconciliation Report

Financial Flow

An overview of the financial flow and reconciliation process

Weekly Reconciliation Report

A walk-through of the weekly reconciliation report