Reconciliation Report Example

Below is a sample Reconciliation Report with a breakdown of the services and fees for that week.

To understand the reconciliation report using your own logistics (WYOL) click here.

For a list of all the report fields and their definitions, see Reconciliation Report Fields

Amount Excl. VAT | Amount Incl. VAT | Amount Inc GST | ||

|---|---|---|---|---|

Sales Total | $23528.85 | $2352.89 | $25881.74 | |

Refunds Total | ($2106.68) | ($210.67) | ($2317.35) | |

Amount to Invoice | $21422.17 | $2142.22 | $23564.39 | |

Service Fee | $1724.12 | $172.41 | $1896.53 | 7.0% of Sales Total |

Service Fee Adjustment | $0.00 | £0.00 | $0.00 | |

Shipping Subsidies | $3649.75 | $364.98 | $4014.73 | |

Taxes Subsidization | $1114.45 | $0.00 | $1114.45 | |

Handling Fee | $140.00 | $14.00 | $154.00 | |

Returns | $14.97 | $1.50 | $16.47 | |

Services and Fees | $6643.29 | $552.89 | $7196.18 |

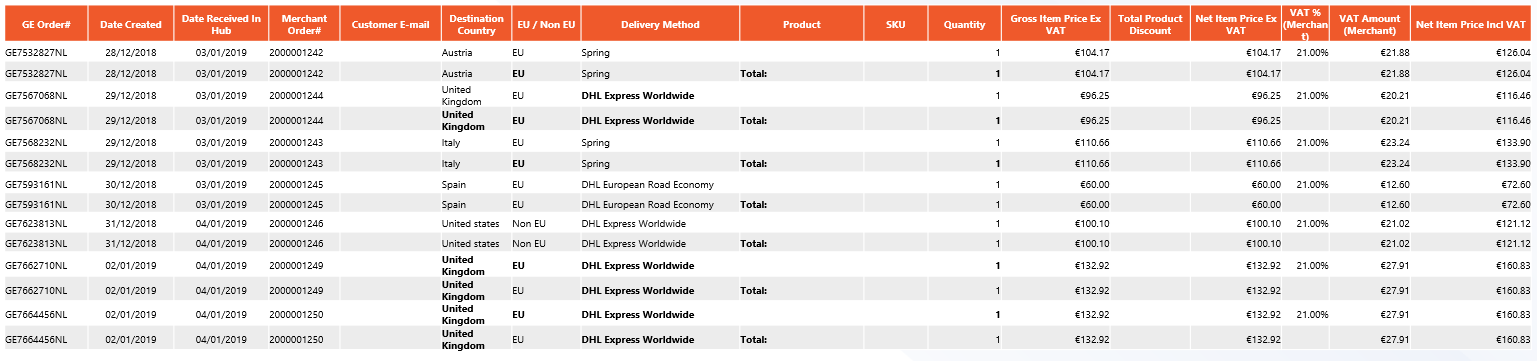

Attachment 1

Order Level

Sales Total on the Order Level

Product Level

Sales total on the Product Level

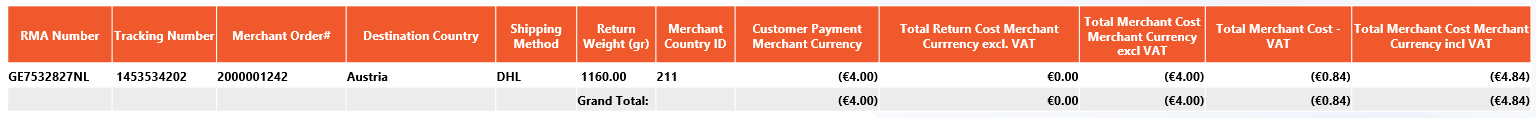

Attachment 2

Lists all the refunds that were issued through Global‑e during the relevant period.

Attachment 3

Shipping prices are based on the actual weight that we received from the shipper or measured at our hub.

shipping costs are reconciled based on the date of the shipment.

Attachment 4

Includes the details of each returned parcel.