Reports

Reports: Dashboard

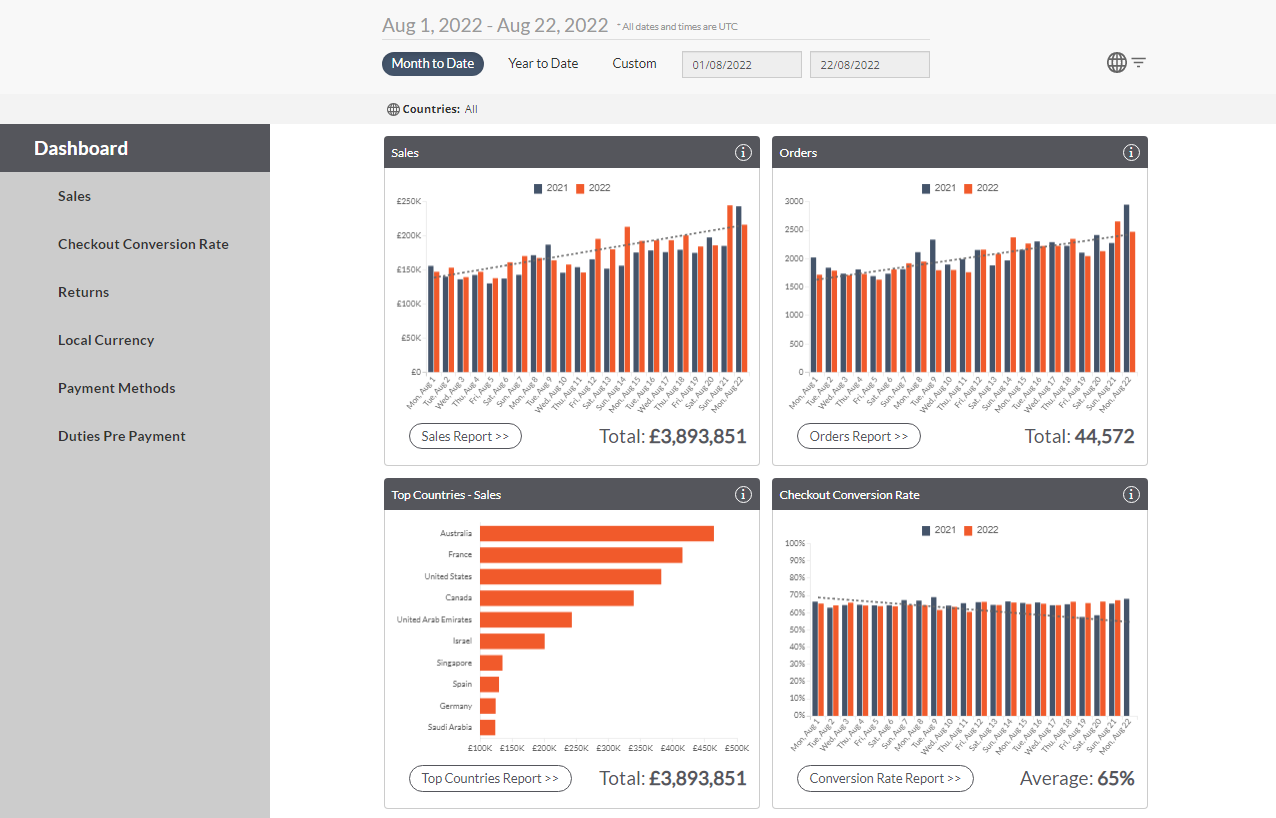

Overview

The Merchant Portal Merchant Dashboard feature is a useful tool for tracking business performance at a glance or in more detail, by means of a clear and user-friendly interface.

To access the Dashboard:

Go to the Merchant Portal, Merchants > Reports > Dashboard.

The Dashboard opens.

The following sections provide a short guide to the dashboard and the reports that you can generate.

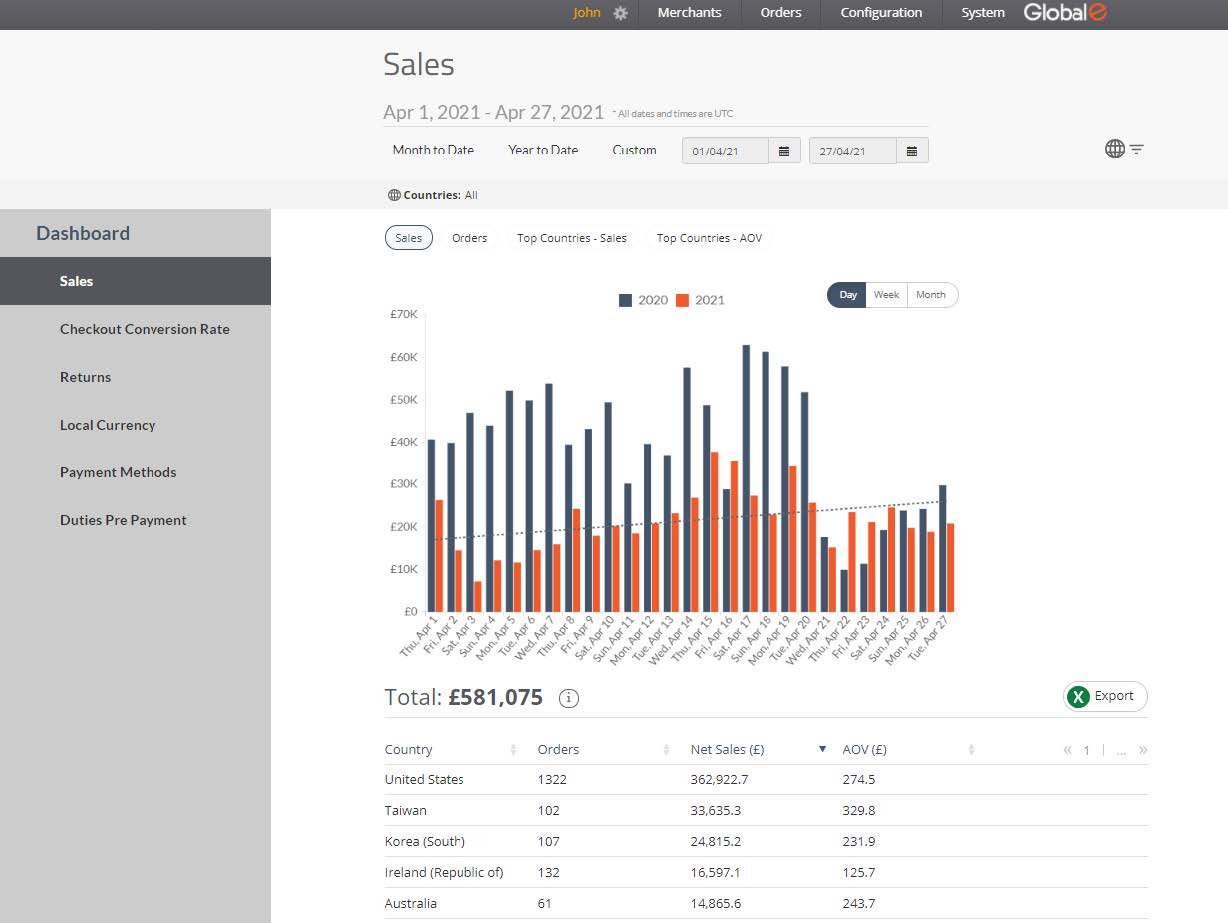

Sales Report

The Sales report shows your revenues from selling your products minus discounts, within the selected period.

The report displays the following business-oriented options (pivots):

Sales

Orders

Top Countries - Sales

Checkout Conversion Rate

Top Countries – AOV

Returns

Local Currency Payment

Payment Methods

Duties Pre-Payment

You can switch the pivot within the main report, while the dashboard displays the views.

The Orders view shows the number of confirmed non-canceled orders.

The Top Countries –Sales presents the first top ten sales-leading countries.

The Top Countries – AOV presents the same countries along with their average order value.

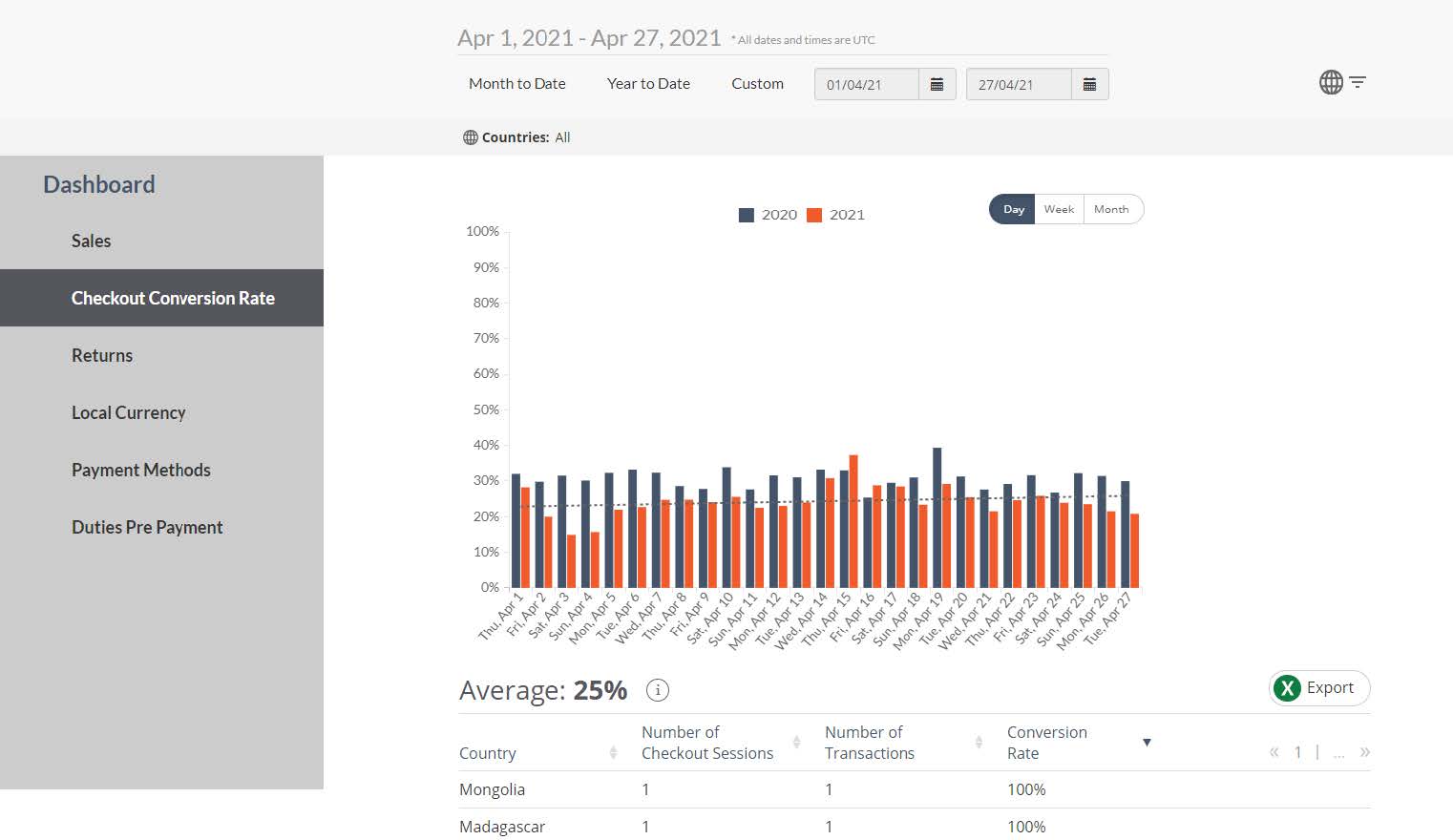

Checkout Conversion Report

This report shows the ratio of confirmed transactions to checkout sessions, as tracked by Google Analytics, within the selected period.

The data is available as of February 2020 onwards and is updated at 9:00 AM UTC time, the previous day.

Note that the only traffic taken into account in this report is from the checkout page.

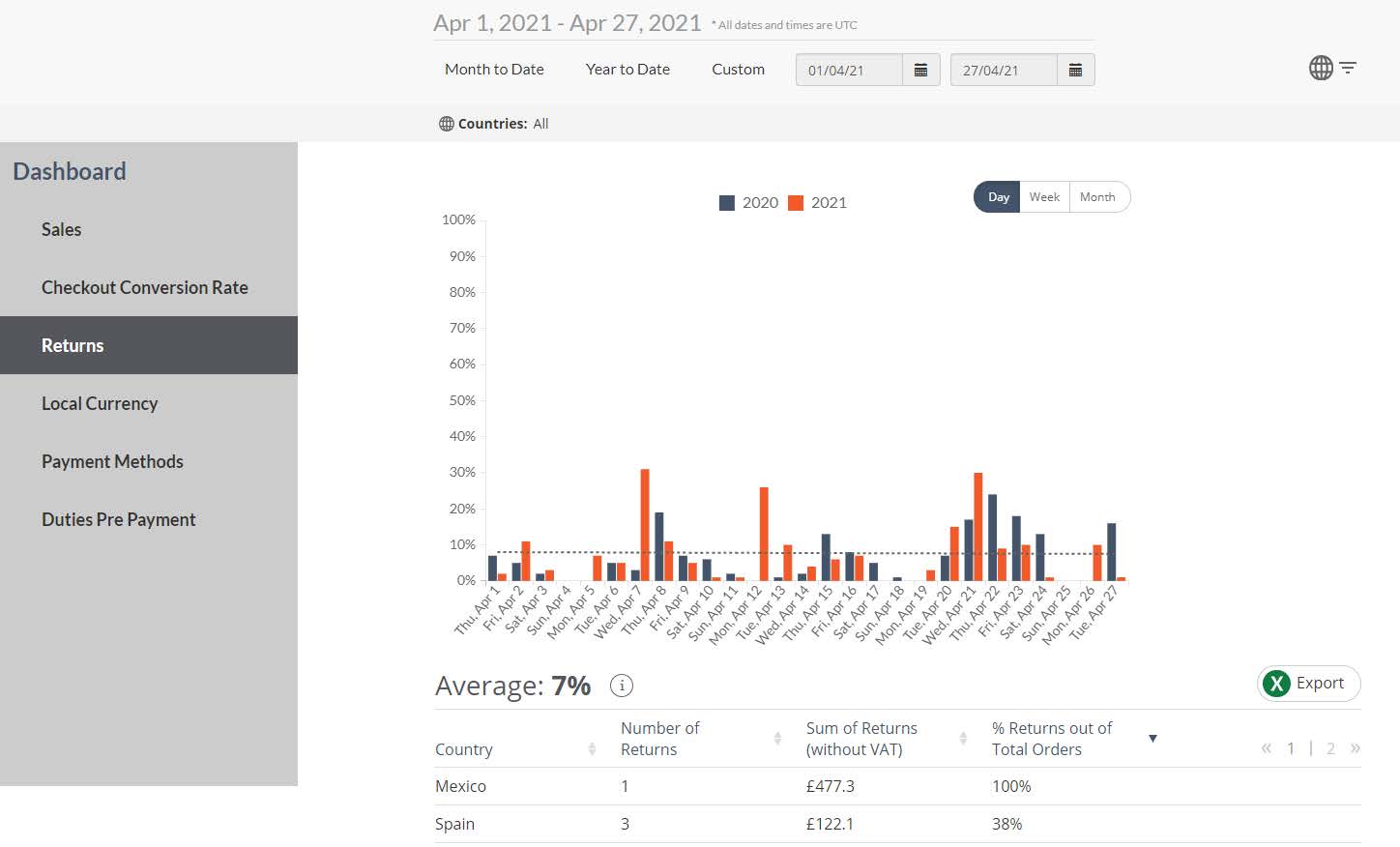

Returns Report

This report shows the percentage of the average of refunds that were issued to customers for returned products, within the selected period.

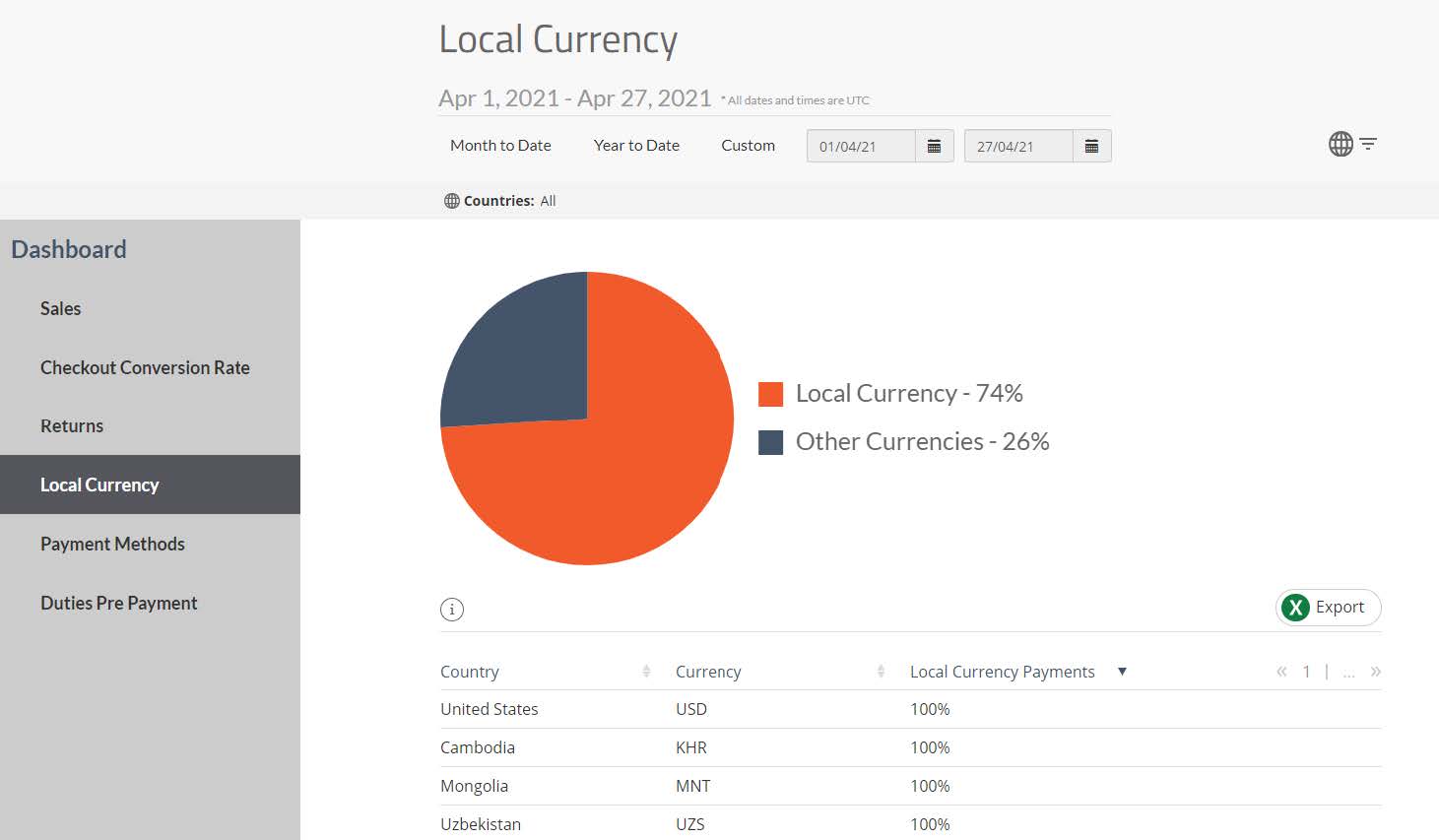

Local Currency Report

This report shows the ratio of confirmed payments in the shopper country‘s currency vs. payments made in any other currency, within the selected period.

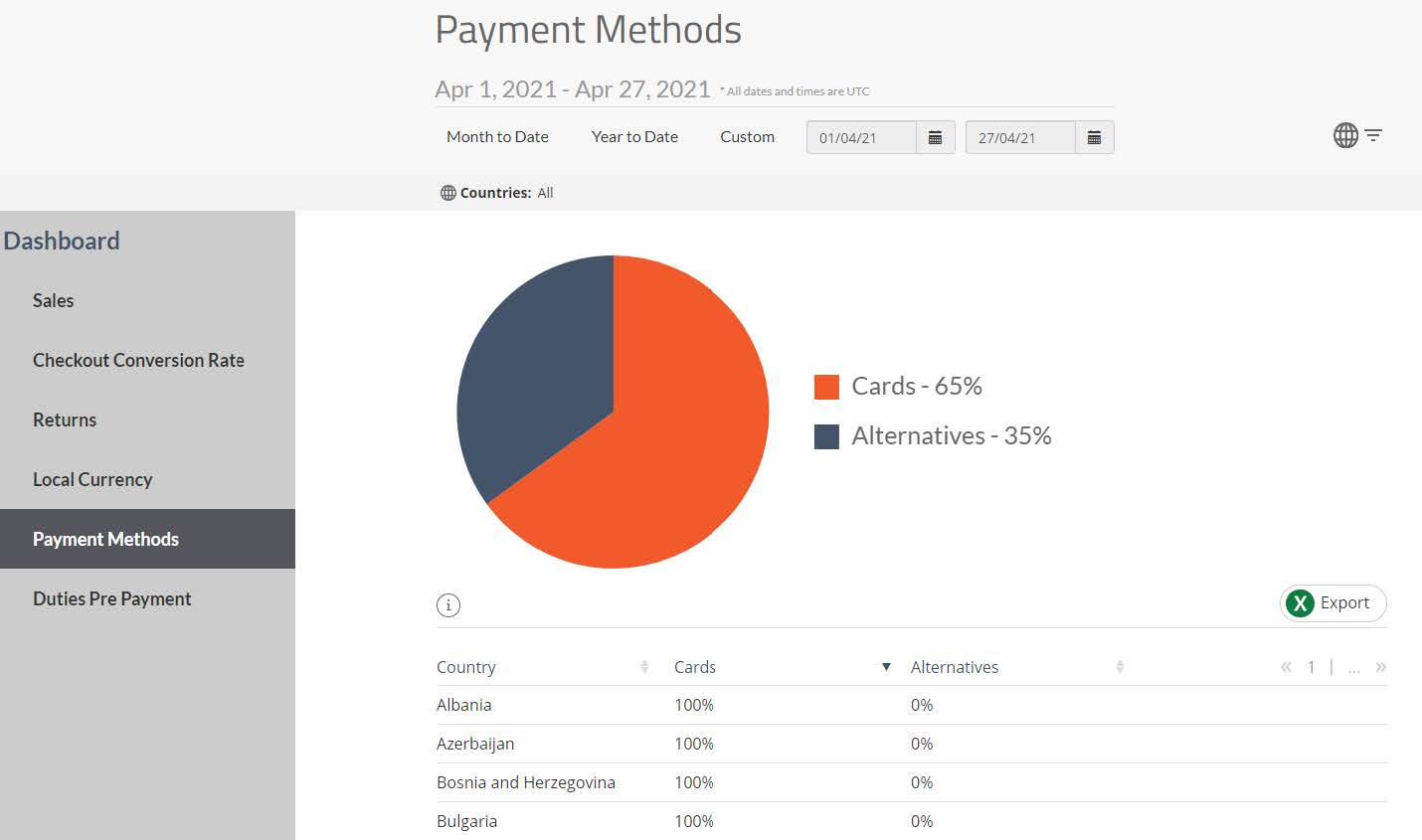

Payment Method Report

This report shows the ratio of confirmed payments via credit/debit cards vs. all other means of payment, within the selected period.

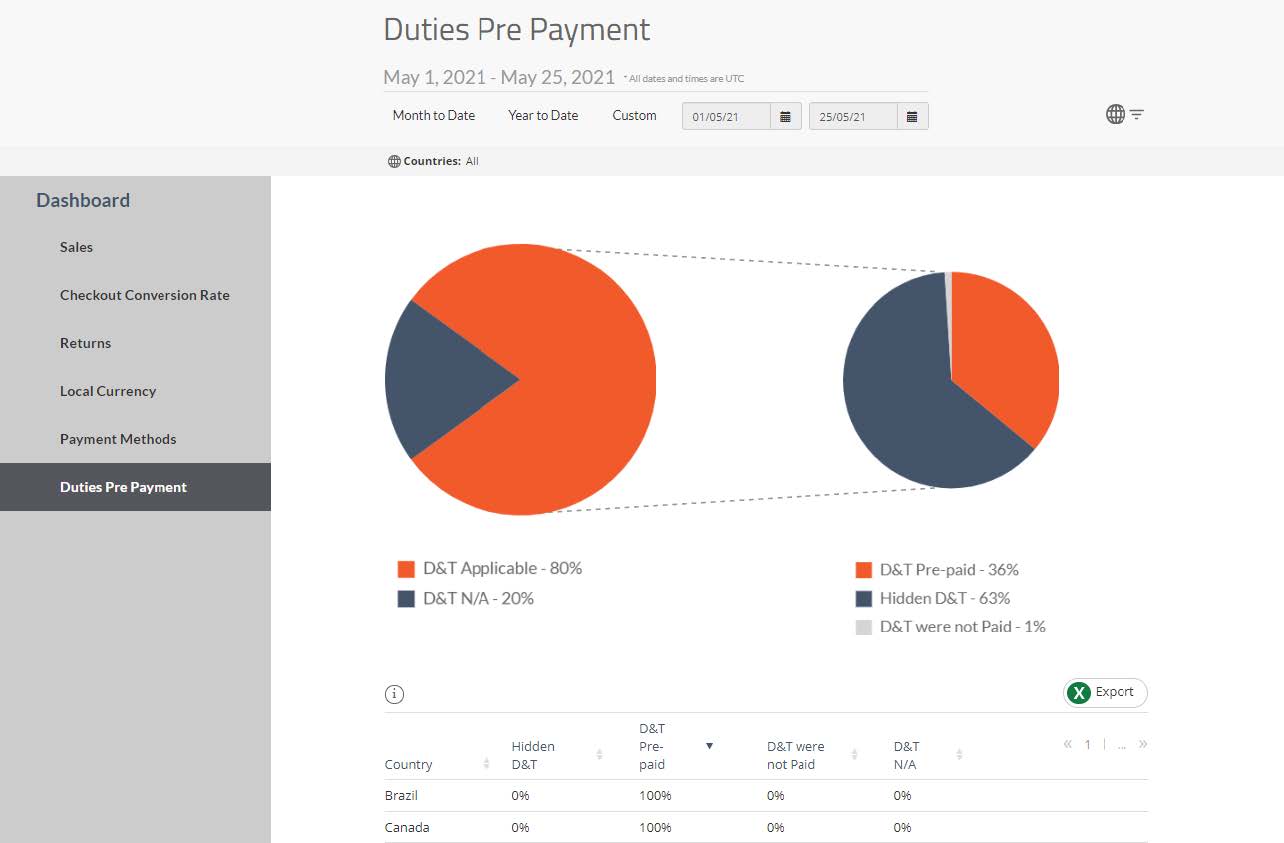

Duties Pre-Payment Report

This report shows the ratio of the different duties pre-payment options that were offered to customers during checkout, within the selected period:

D&T pre-paid – Percentage of orders where customers selected to pay duties & taxes at the checkout.

D&T were not paid – Percentage of orders where customers selected not to pay duties & taxes at the checkout.

Hidden D&T – Percentage of orders with duties & taxes included in the product price as per merchant settings.

D&T applicable – Orders that are liable for duties & taxes according to the destination country’s duties regime.

D&T N/A –Orders that are below the duties & taxes threshold of the destination country or orders delivered by shipping services that do not support D&T prepayment.

Report Features

Date and Country Filters

Two pre-defined filters can be used (Month to Date / Year to Date) to set the date range or a customized period can be selected.

Data is always shown up to the previous day.

Through the country filter, specific countries can be selected to be shown in the report.

By default, all countries that contributed at least one order within the selected period, are selected in the list.

The Reconciliation Report

The Reconciliation Report provides a comprehensive detail of all your sales. It is generated automatically once a week and continually monitored by the Global-e finance team.

The Reconciliation Report is sent to you by email each week.

The Reconciliation Report is presented in your local currency, and the information is aligned with the rules and regulations of your specific country.

A detailed Reconciliation Report contains:

A summary of all orders dispatched during the period.

A breakdown of each order by product, including a breakdown of cart and product discounts.

A summary of all related shipping and Duties and Taxes costs and subsidies.

A summary of refunds issued within the period, and a breakdown of these refunds by product.

A summary of all returns costs and subsidies for returns that took place during the period.

A summary of all totals in the report for ease of invoicing.

Important

With each report:

The Sales Total serves as the basis for the service fee calculation each week.

Orders are included for reconciliation according to the ‘Received In Hub’ date and refunds by their creation date.

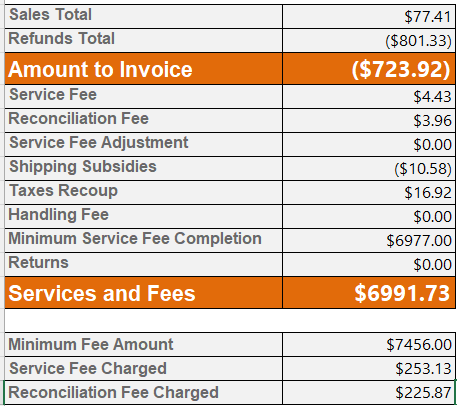

Reconciliation Report Example

The Reconciliation Report Explained

The following video explains the structure of the weekly reconciliation report.

Below is a sample Reconciliation Report with a breakdown of the services and fees for that week.

To understand the reconciliation report using your own logistics (WYOL) click here.

For a list of all the report fields and their definitions, see Reconciliation Report Fields

Amount Excl. VAT | VAT | Amount Incl. VAT | ||

|---|---|---|---|---|

Sales Total | £23528.85 | £4705.77 | £28234.62 | |

Refunds Total | (£2106.68) | (£423.79) | (£2530.47) | |

Amount to Invoice | £21422.17 | £4281.98 | £25704.15 | |

Service Fee | £1899.44 | £379.89 | £2279.33 | 7.50% of Total Order Value |

Shipping Subsidies | £3,649.75 | £0.00 | £3,649.75 | |

Taxes Subsidization | £1114.45 | £0.00 | £1114.45 | |

Handling Fee | £140.00 | £28.00 | £168.00 | |

Returns | £14.97 | £2.99 | £17.96 | |

Services and Fees | £6818.61 | £410.88 | £7229.49 |

Attachment 1

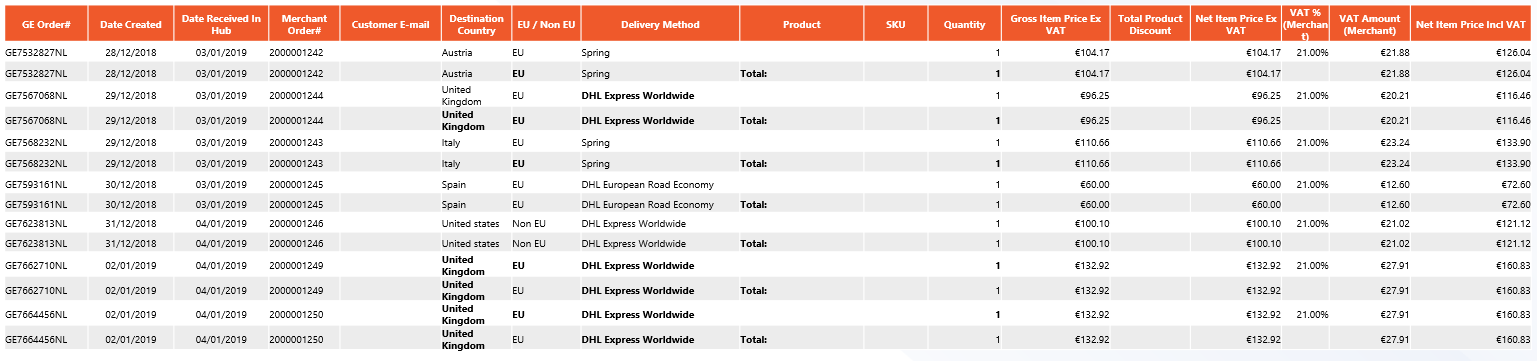

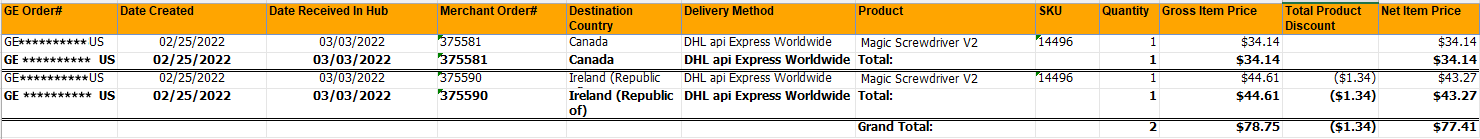

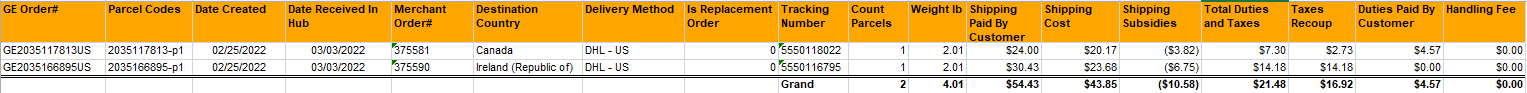

Order Level

Sales Total on the Order Level

Product Level

Sales total on the Product Level

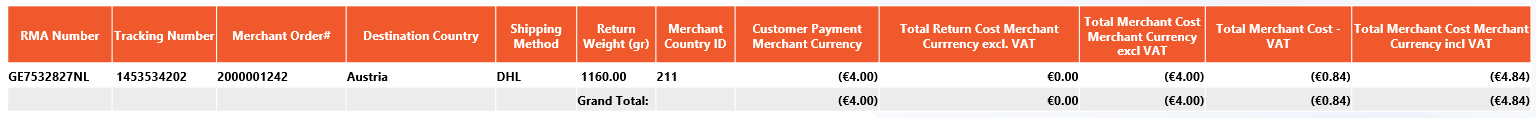

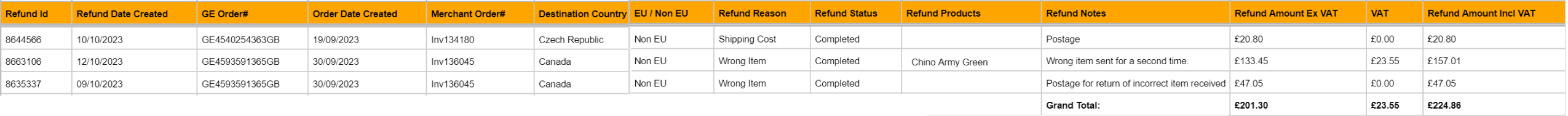

Attachment 2

Lists all the refunds that were issued through Global‑e during the relevant period

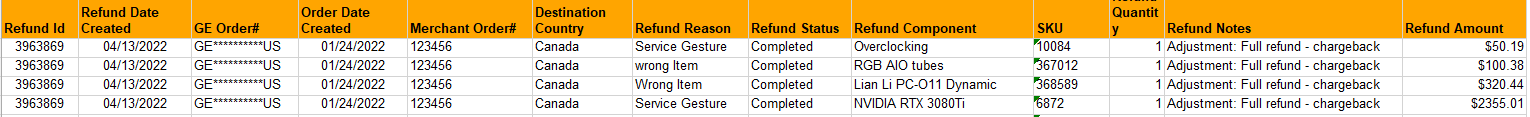

Attachment 3

Shipping prices are based on the actual weight that we received from the shipper or measured at our hub.

shipping costs are reconciled based on the date of the shipment

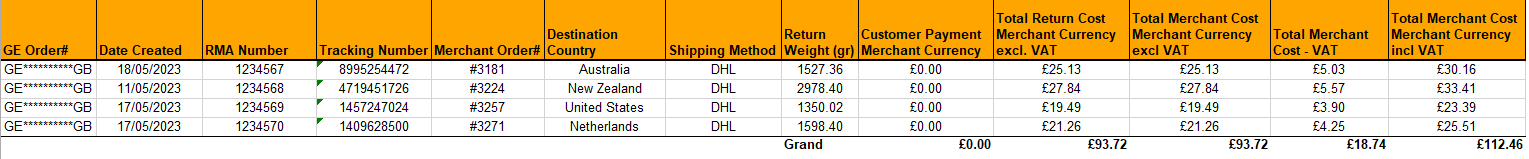

Attachment 4

Includes the details of each returned parcel

Reconciliation Report Fields

The Reconciliation Report includes the following sections, which you can view by selecting the desired tab at the bottom of the report:

Below is an explanation of the fields in each section.

Summary

Amount to Invoice: The total of all sales from the period, including discounts (Sales Total), minus the refunds processed during the period (Refunds Total).

Sales Total: Total of all sales from the period.

Refunds Total: Refunds processed during the period.

Services and Fees

Service Fee: A fee based on the percentage per contract and calculated on the total order value paid by the customer at checkout.

Base for Reconciliation Fee: A calculation based on the Total Order Value paid by the customer

Reconciliation Fee Percentage: The fee percentage noted in the contract.

Reconciliation Fee: Percentage per contract of the base for Reconciliation Fee noted above

Shipping Subsidies: The difference between the total cost of shipping and the fixed price paid by the customer. This is also according to your configuration.

Taxes Recoup: Duties & Taxes that you have chosen to subsidize for the client.

Handling Fee: The handling fees for each order which are processed through the Global-e Merchant hub.

Minimum Service Fee Completion:

Returns: The shipping cost for each return shipped back during the period.

Products and Orders

GE Order#: A unique Global-e ID is created for each order in our system. For example, GE7733229GB

Date Created: The date on which the order is created in the Global-e's system.

Date Received in the Hub: This date can have two meanings. If you are shipping through the Global-e Merchant hub, this will be the day the order is scanned into the hub. If you are shipping directly to the end customer, this will be the same as the date of shipment.

Merchant Order #: Your ID number for the order, generally taken from your platform.

Destination Country: The destination country to which the order is shipped.

Delivery Method: The shipping method selected by the customer at checkout.

Product: Description of the product

SKU: Product identification number

Quantity: Quantity of each product

Gross Item Price: The price of each product or total of the order excluding Merchant VAT and before the deduction of discounts.

Total Product Discount: The discount value against each product or order excluding Merchant VAT.

Net Item Price: The price of each product or total of the order excluding Merchant VAT and after the deduction of discounts.

Shipping Per Parcel

GE Order#: A unique Global-e ID created for each order in the system - for example, GE7733229GB

Parcel Codes: A unique identifier for each parcel - there may be more than one parcel per order.

Date Created: The date on which the order is created in Global-e's system.

Date Received in the Hub: This date can have two meanings. If you are shipping through the Global-e Merchant hub, this will be the day the order is scanned into the hub. If you are shipping directly to the end customer, this will be the same as the date of shipment.

Merchant Order #: Your ID number for the order, generally taken from your platform.

Destination Country: The destination country to which the order is shipped.

Delivery Method: The shipping method selected by the customer at checkout.

Is Replacement Order: Is this parcel for a replacement order, yes or no?

Tracking Number: The tracking number for each parcel.

Count Parcels: The number of parcels attributed to a single line.

Weight Ib/Kg: The total weight of the parcels attributed to this line.

Shipping Paid by Customer: The shipping cost paid by the customer - a fixed rate according to the configuration.

Shipping Cost: Total actual shipping cost.

Shipping Subsidies: Excluding VAT Subsidisation of shipping cost - the difference between the amount paid by the customer and the total shipping cost.

Total Duties and Taxes: Total duties & taxes related to all parcels included in each line.

Taxes Recoup: Subsidisation of duties and taxes if you have chosen to subsidize duties & taxes, either fully or partially.

Duties Paid by Customer: Duties & taxes paid by the customer.

Handling Fee: The handling fees for each order which is processed through the Global-e Merchant hub.

Refunds

Refund Id: A unique Global-e ID created for each refund or adjustment in the system.

Refund Date Created: The creation date of the refund or adjustment in Global-e's system.

GE Order#: A unique Global-e ID created for each order in the system - for example, GE7733229GB

Order Date Created: The date on which the order is created in Global-e's system.

Merchant Order#: Your ID number for the order, generally taken from your platform.

Destination Country: The destination country to which the order was shipped.

Refund Reason: The reason given for the refund or adjustment.

Refund Status: The status of the refund or adjustment - for example, completed or manual.

Refund Products: All the products included in the refund or adjustment.

Refunds Components

Refund ID: A unique Global-e ID created for each refund or adjustment in the system.

Refund Date Created: Creation date of the refund or adjustment in Global-e's system.

GE Order#: A unique Global-e ID created for each order in the system - for example, GE7733229GB

Order Date Created: The date on which the order is created in Global-e's system.

Merchant Order#: Your ID number for the order, generally taken from your platform.

Destination Country: The destination country to which the order is shipped.

Refund Reason: The reason given for the refund or adjustment created in Global-e's system.

Refund Status: The status of the refund or adjustment - for example, completed or manual.

Refund Component Products reimbursed or adjusted by line, including all descriptions and SKUs.

Quantity: The quantity of each product refunded or included in the adjustment.

Refund Notes: Notes added when the refund or adjustment is created in Global-e's system.

Refund Amount: Ex VAT Total of the refund or adjustment, excluding VAT.

Returns

GE Order #: A unique Global-e ID created for each order in the system - for example, GE7733229GB.

Date Created: The date on which the order is created in Global-e's system.

RMA Number: A unique ID number created for each return label - RMA.

Tracking Number: The tracking number for each parcel.

Merchant Order #: Your ID number for the order, generally taken from your platform.

Destination Country: The destination country to which the order is shipped.

Shipping Method: The delivery method used for the return shipment.

Return Weight: The actual weight of the return in kilos or pounds.

Customer Payment Merchant Currency: Return shipping costs paid by the customer - a fixed rate according to configuration.

Total Return Cost Merchant Currency: The total return costs, excluding VAT.

Total Merchant Cost Merchant Currency: The total cost to the Merchant, excluding VAT; this is the difference between the amount paid by the customer and the total

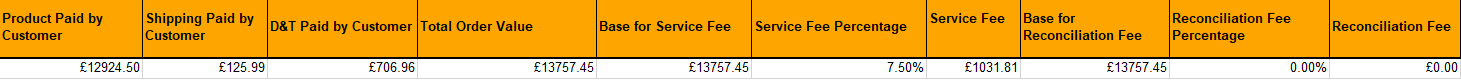

Service Fee

Product Paid by Customer: The total product paid by the customer at checkout and as reflected in the orders and products tabs totals.

Shipping Paid by Customer: Total shipping paid by the customer as reflected in column L of the reconciliation report.

D&T Paid by Customer: Total D&Ts paid by the customer as reflected in column Q of the reconciliation report.

Total Order Value: The total order value used as the base to calculate the service fee.

Base for Service Fee: The total order value used as the base to calculate the service fee.

Service Fee Percentage: The Percentage from the contract used to calculate the service fee; referred to as the platform fee in the contract.

Service Fee: The service fee based on the percentage listed in the field above, based on the total order value paid by the customer, also listed in the fields above.

Base for Reconciliation Fee: The fee calculation based on the Total Order Value paid by the customer

Reconciliation Fee Percentage: Percentage from the contract used to calculate the payment processing fee.

Reconciliation Fee: Percentage per contract of the base for Reconciliation Fee noted above.