UK Merchants with Non-Global-e Carriers

When an international customer visits your site, Global-e converts the price of your product to the customer's currency. At checkout, the customer is presented with the financial details of the transaction:

After verifying the validity of the transaction, Global‑e collects the payment and the order is packed and shipped.

Global-e then converts the amount of the sale back to your currency and refunds you the amount of the sale, deducting relevant fees and subsidies. If you are using your own carriers then the shipping fee, plus duties and taxes (if paid for by the carrier), are included in the refund. For more information, see The Reconciliation Process. |

Duties and Taxes Process

Merchants can choose between two methods of collecting duties and taxes from customers:

Optional/Forced DDP : Customers pre-pay duties and taxes at checkout, which are passed by Global-e to the Merchant, and in most cases passed on to their shipper. However in some countries, like the US, Global-e will retain and remit these to the authorities directly.

Hidden Forced DDP : Duties and taxes are built into the amount paid by the end customer. For most countries, Global-e will pass the full value of the product to the Merchant, including the duties and taxes intended for the shipper. In some countries like Australia, Global-e will retain and remit these taxes directly to the authorities.

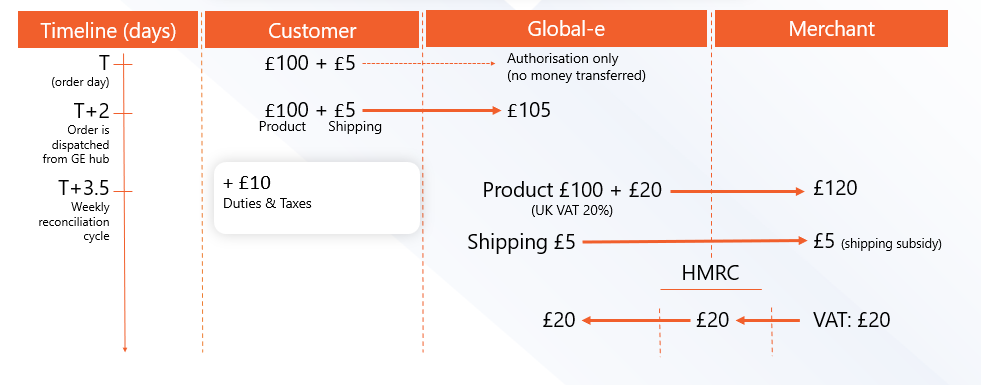

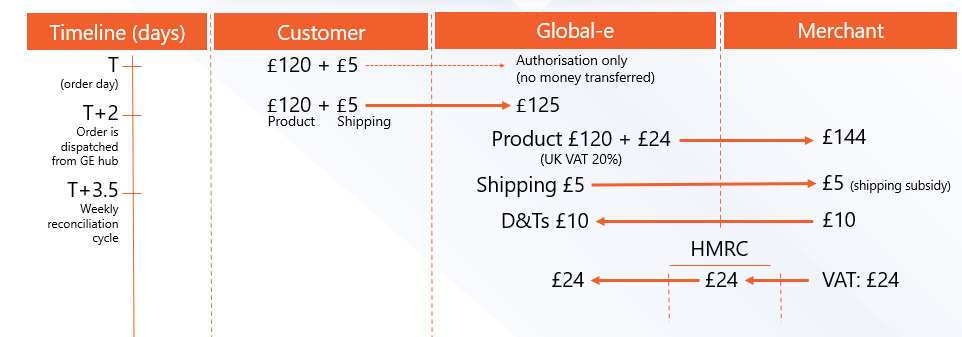

Below are two examples of the financial process that takes place when a non-UK customer makes a purchase from a British Merchant.

British Merchant – Non-UK Customer

Example: Optional/Forced DDP for Duties & Taxes

Product price in UK = £120 (£100 + 20% VAT) - exported out of the UK

Shipping cost charged to customer £5

Net product sale for Merchant: £100

Net after shipping subsidy: £105

British Merchant – Non-UK Customer

Example: Hidden Forced DDP for Duties & Taxes

Product price in UK = £120 (£100 + 20% VAT) - exported out of the UK

Shipping cost charged to customer £5

Net product sale for Merchant: £120

Net after shipping subsidy: £115

Billing Period And Payment Terms

The reconciliation process typically takes place on a weekly basis and results in a comprehensive report of all Merchant sales for the week.

Based on the report, Global-e pays the Merchant the sum of all products sold internationally during that week plus any relevant shipping, duties, and taxes, minus the agreed service fee.

Global-e's standard payment terms:

80% of the net proceeds are paid weekly, up to two business days after the weekly reporting day.

20% of the net proceeds are paid seven days after the end of each calendar month.

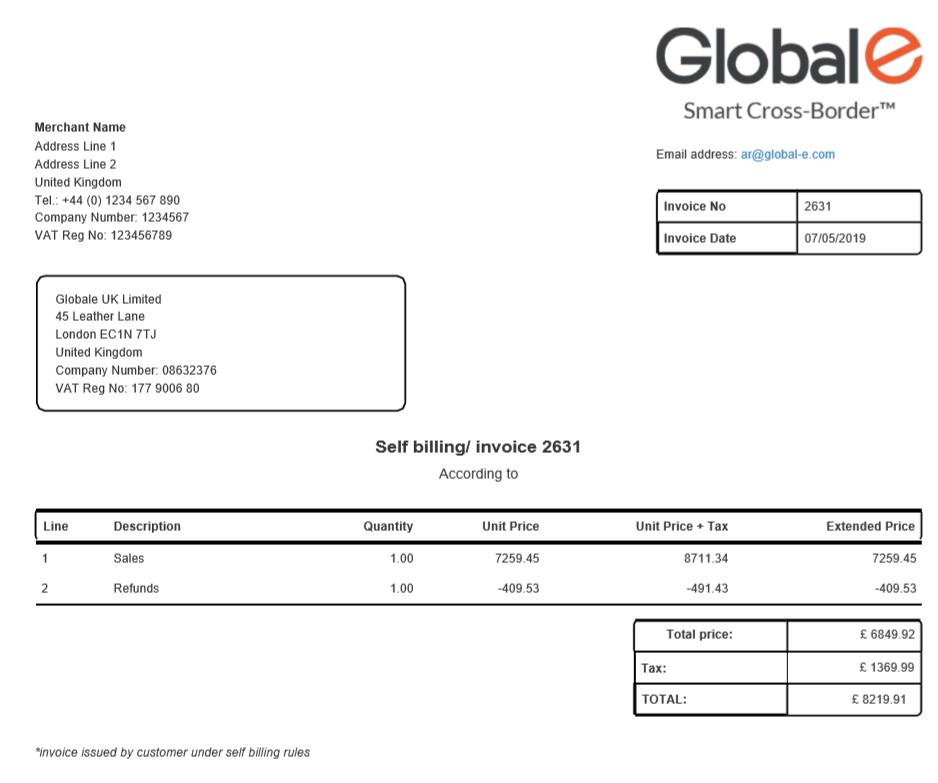

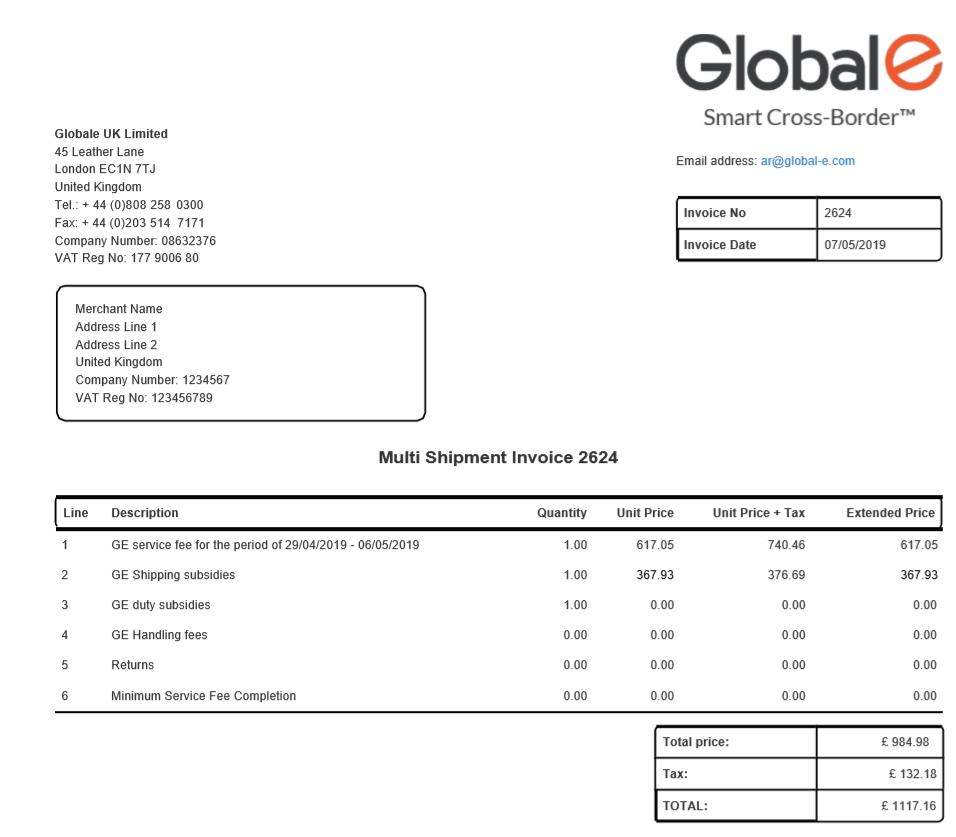

Invoicing

When the Reconciliation Report is generated, Global-e also provides Merchants with two invoices:

A self-billing invoice for sales less refunds.

An invoice for Global-e’s services, fees, and any shipping subsidies.

To view the invoice go to the Global-e Merchant Portal > Merchants > Reports > Reconciliation Reports.

Invoice for Service and Fees

Credit Note for Net Sales

Global-e Purchase Examples

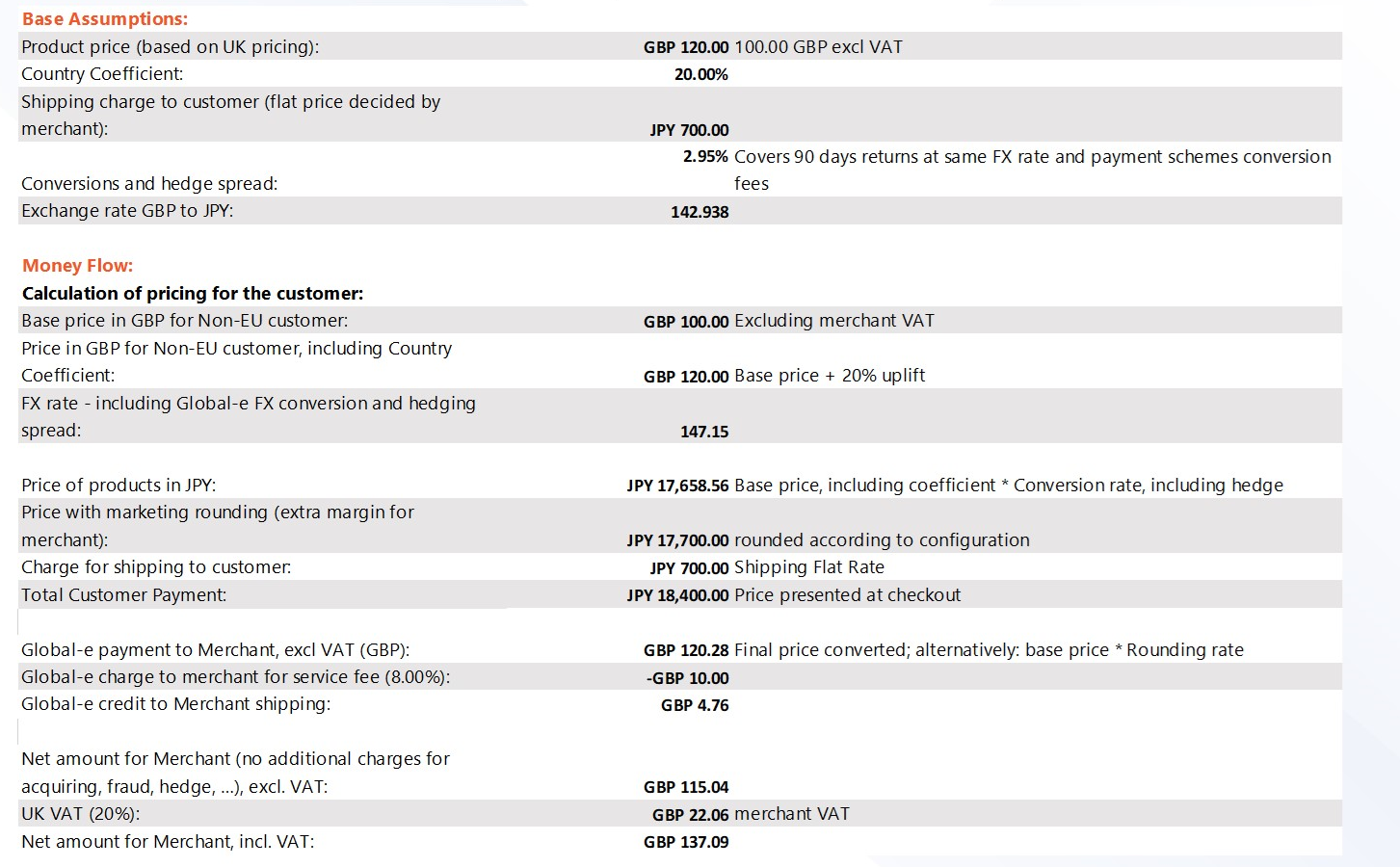

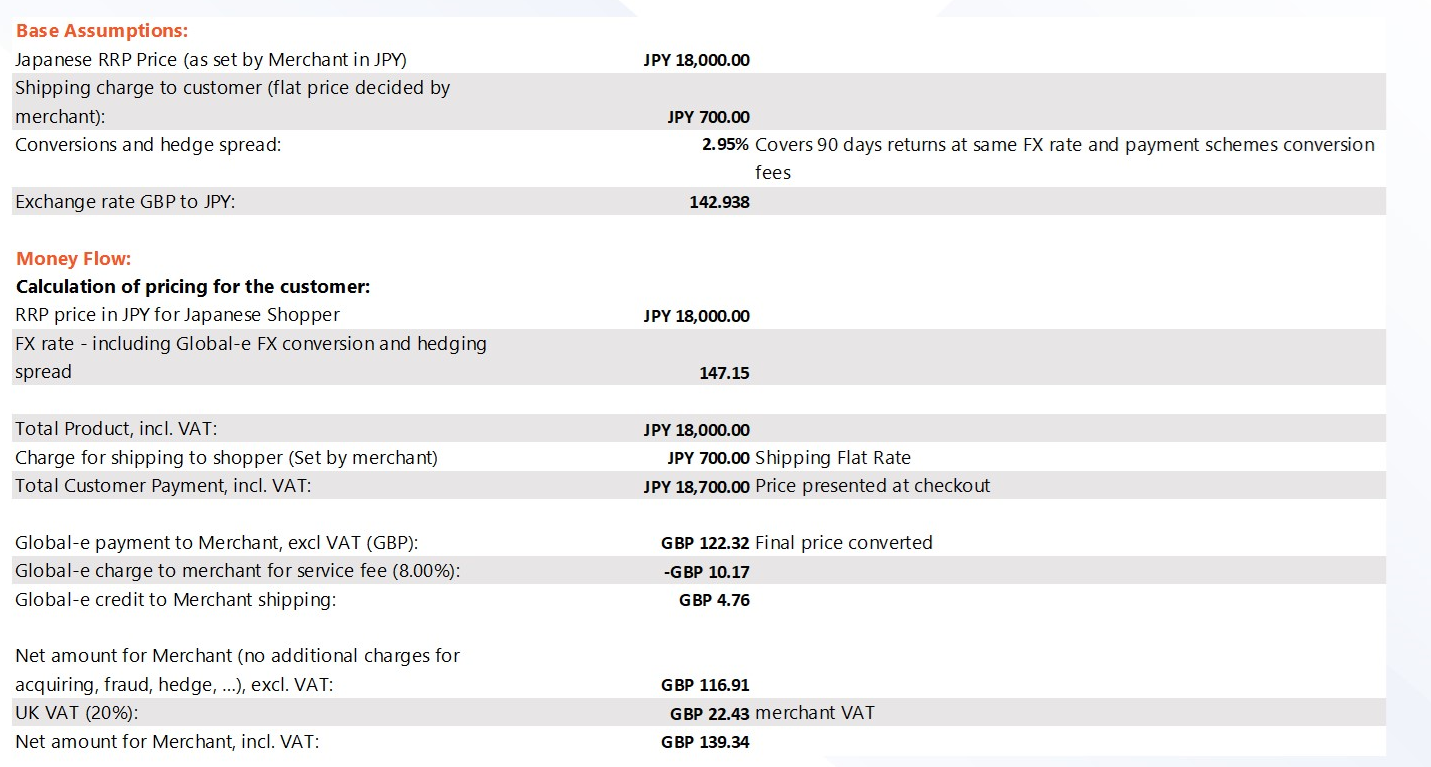

The following two purchase examples offer a detailed look at the price conversion process.

There are two types of conversions:

Dynamic pricing - Global-e converts the customer currency on the website for the Merchant.

Fixed pricing - The Merchant gives Global-e the customer's price in the customer's currency and that information is fed into the website.

British Merchant – Non-UK Customer

Example of dynamic pricing

British Merchant – Non-UK Customer

Example of fixed pricing

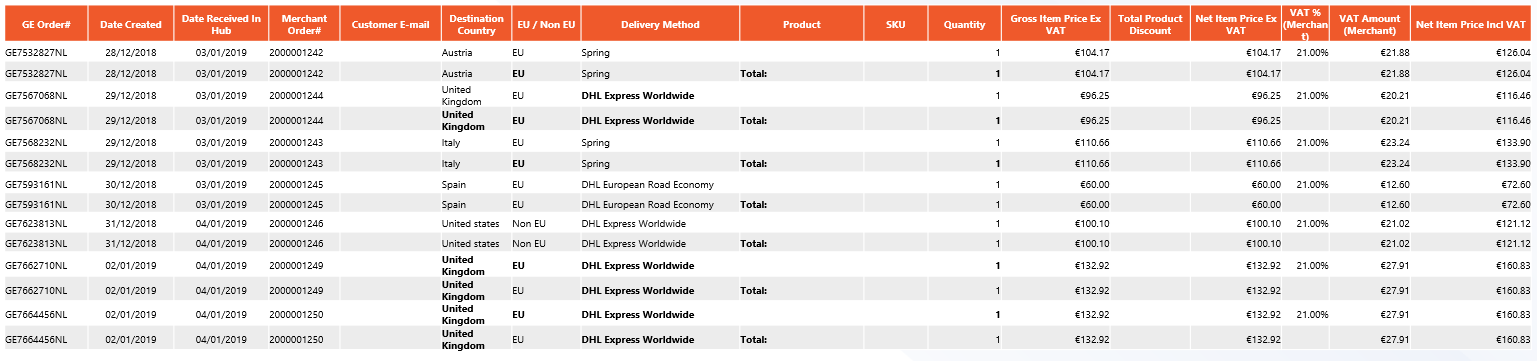

Periodic Reconciliation Report - UK Merchants

Below is a sample Reconciliation Report with a breakdown of the services and fees for that week.

For a list of all the report fields and their definitions, see Reconciliation Report Fields

Amount Excl. VAT | VAT | Amount Incl. VAT | ||

|---|---|---|---|---|

Sales Total | £23528.85 | £4705.77 | £28234.62 | |

Refunds Total | (£2106.68) | (£423.79) | (£2530.47) | |

Amount to Invoice | £21422.17 | £4281.98 | £25704.15 | |

Service Fee | £1964.01 | £392.80 | £2356.81 | 8.00% of Total Order Value |

Service Fee Adjustment | £0.00 | £0.00 | £0.00 | |

Shipping Subsidies (EU) | (£276.23) | £0.00 | (£276.23) | |

Shipping Subsidies (Non-EU) | (£373.52) | £0.00 | (£373.52) | |

Taxes Subsidization | (£371.48) | £0.00 | (£371.48) | |

Handling Fee | £0.00 | £0.00 | £0.00 | |

Returns | £14.97 | £2.99 | £17.96 | |

Services and Fees | £927.81 | £389.81 | £1317.62 |

Attachment 1

Order Level

Sales Total on the Order Level

Product Level

Sales total on the Product Level

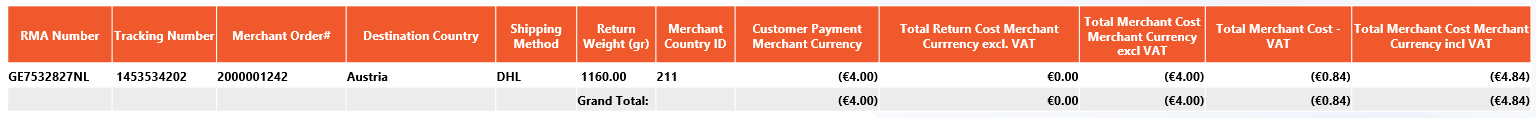

Attachment 2

Lists all the refunds that were issued through Global‑e during the relevant period

Attachment 3

Shipping prices are based on the actual weight that we received from the shipper or measured at our hub.

shipping costs are reconciled based on the date of the shipment

Attachment 4

Includes the details of each returned parcel