Reports

Reconciliation Report

The Reconciliation Report is a structured financial data file provided by Global-e to merchants. It offers comprehensive details of all your sales. The report is generated automatically once a week and the Global-e Finance team is available for any questions regarding the files or data.

A detailed Reconciliation Report contains:

A breakdown of each order by product, including a breakdown of cart and product discounts.

A summary of all orders dispatched during the period.

A summary of all related shipping and Duties and Taxes costs and subsidies.

A summary of refunds issued within the period, and a breakdown of these refunds by product.

A summary of all returns costs and subsidies for returns that took place during the period.

A summary of all totals in the report for ease of invoicing.

For a detailed explanation of the Reconciliation Report, please see the ???.

Accessing Your Reconciliation Report

This section tells you how to access your Reconciliation report.

Navigate to Merchants > Reports > Reconciliation Report from the top menu.

Select a merchant from the Merchant menu.

Select a date period from the Report menu.

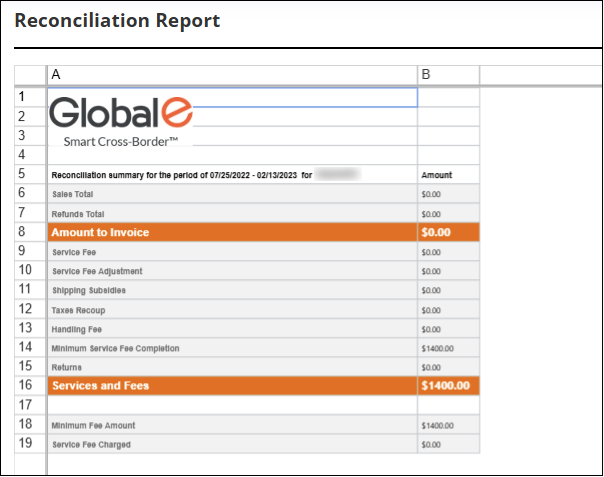

The Reconciliation Report page is displayed showing a summary of the latest billing period.

The reconciliation report is presented in your local (merchant) currency, and the information is aligned with the rules and regulations of your specific country.

Downloading and Printing Reconciliation Reports

From this screen you can also download or print your reconciliation reports or invoices by doing one or more of the following:

Download Report - to download the Reconciliation Report.

Print - to print the Reconciliation Report.

Invoice - to download the invoice associated with the selected report.

Reconciliation Report Fields

The Reconciliation Report includes the following sections, which you can view by selecting the desired tab at the bottom of the report:

Below is an explanation of the fields in each section.

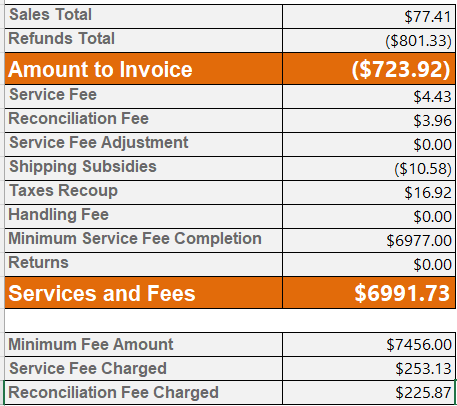

Summary

This section summarizes the fields shown in the summary:

Amount to Invoice: The total of all sales from the period, including discounts (Sales Total), minus the refunds processed during the period (Refunds Total).

Sales Total: Total of all sales from the period.

Refunds Total: Refunds processed during the period.

Services and Fees

Service Fee: A fee based on the percentage per contract and calculated on the total order value paid by the customer at checkout.

Base for Reconciliation Fee: A calculation based on the Total Order Value paid by the customer

Reconciliation Fee Percentage: The fee percentage noted in the contract.

Reconciliation Fee: Percentage per contract of the base for Reconciliation Fee noted above

Shipping Subsidies: The difference between the total cost of shipping and the fixed price paid by the customer. This is also according to your configuration.

Taxes Recoup: Duties & Taxes that you have chosen to subsidise for the client.

Handling Fee: The handling fees for each order which are processed through the Global-e Merchant hub.

Minimum Service Fee Completion:

Returns: The shipping cost for each return shipped back during the period.

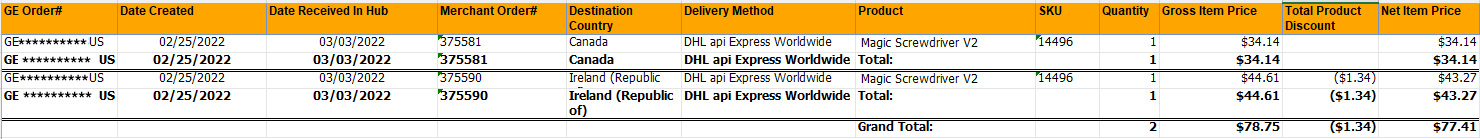

Products and Orders

GE Order#: A unique Global-e ID is created for each order in our system. For example, GE7733229GB

Date Created: The date on which the order is created in the Global-e's system.

Date Received in the Hub: This date can have two meanings. If you are shipping through the Global-e Merchant hub, this will be the day the order is scanned into the hub. If you are shipping directly to the end customer, this will be the same as the date of shipment.

Merchant Order #: Your ID number for the order, generally taken from your platform.

Destination Country: The destination country to which the order is shipped.

Delivery Method: The shipping method selected by the customer at checkout.

Product: Description of the product

SKU: Product identification number

Quantity: Quantity of each product

Gross Item Price: The price of each product or total of the order excluding Merchant VAT and before the deduction of discounts.

Total Product Discount: The discount value against each product or order excluding Merchant VAT.

Net Item Price: The price of each product or total of the order excluding Merchant VAT and after the deduction of discounts.

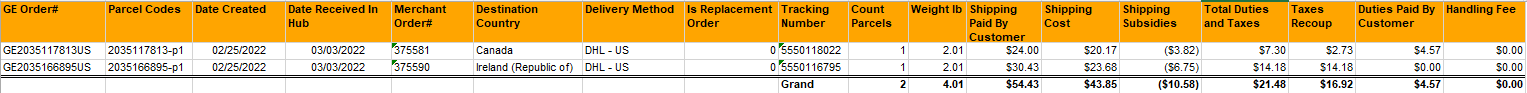

Shipping Per Parcel

The following figure shows the Shipping Per Parcel report:

GE Order#: A unique Global-e ID created for each order in the system - for example, GE7733229GB

Parcel Codes: A unique identifier for each parcel - there may be more than one parcel per order.

Date Created: The date on which the order is created in Global-e's system.

Date Received in the Hub: This date can have two meanings. If you are shipping through the Global-e Merchant hub, this will be the day the order is scanned into the hub. If you are shipping directly to the end customer, this will be the same as the date of shipment.

Merchant Order #: Your ID number for the order, generally taken from your platform.

Destination Country: The destination country to which the order is shipped.

Delivery Method: The shipping method selected by the customer at checkout.

Is Replacement Order: Is this parcel for a replacement order, yes or no?

Tracking Number: The tracking number for each parcel.

Count Parcels: The number of parcels attributed to a single line.

Weight Ib/Kg: The total weight of the parcels attributed to this line.

Shipping Paid by Customer: The shipping cost paid by the customer - a fixed rate according to the configuration.

Shipping Cost: Total actual shipping cost.

Shipping Subsidies: Excluding VAT Subsidisation of shipping cost - the difference between the amount paid by the customer and the total shipping cost.

Total Duties and Taxes: Total duties & taxes related to all parcels included in each line.

Taxes Recoup: Subsidisation of duties and taxes if you have chosen to subsidize duties & taxes, either fully or partially.

Duties Paid by Customer: Duties & taxes paid by the customer.

Handling Fee: The handling fees for each order which is processed through the Global-e Merchant hub.

Refunds

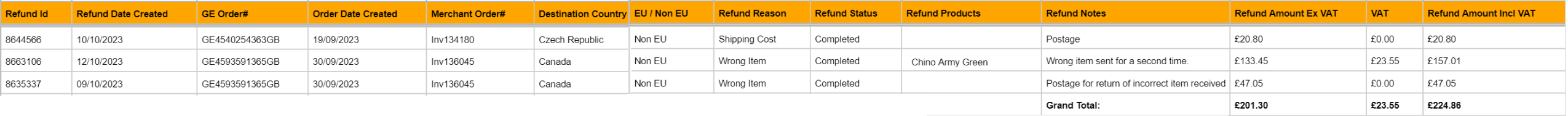

The following figure shows the Refunds report:

Refund Id: A unique Global-e ID created for each refund or adjustment in the system.

Refund Date Created: The creation date of the refund or adjustment in Global-e's system.

GE Order#: A unique Global-e ID created for each order in the system - for example, GE7733229GB

Order Date Created: The date on which the order is created in Global-e's system.

Merchant Order#: Your ID number for the order, generally taken from your platform.

Destination Country: The destination country to which the order was shipped.

Refund Reason: The reason given for the refund or adjustment.

Refund Status: The status of the refund or adjustment - for example, completed or manual.

Refund Products: All the products included in the refund or adjustment.

Refund Components

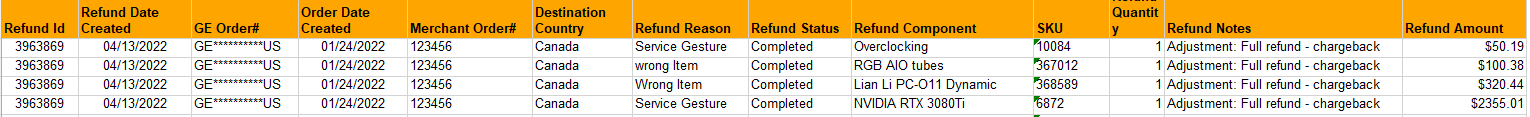

The following figure shows the Refund Components report:

Refund ID: A unique Global-e ID created for each refund or adjustment in the system.

Refund Date Created: Creation date of the refund or adjustment in Global-e's system.

GE Order#: A unique Global-e ID created for each order in the system - for example, GE7733229GB

Order Date Created: The date on which the order is created in Global-e's system.

Merchant Order#: Your ID number for the order, generally taken from your platform.

Destination Country: The destination country to which the order is shipped.

Refund Reason: The reason given for the refund or adjustment created in Global-e's system.

Refund Status: The status of the refund or adjustment - for example, completed or manual.

Refund Component Products reimbursed or adjusted by line, including all descriptions and SKUs.

Quantity: The quantity of each product refunded or included in the adjustment.

Refund Notes: Notes added when the refund or adjustment is created in Global-e's system.

Refund Amount: Ex VAT Total of the refund or adjustment, excluding VAT.

Returns

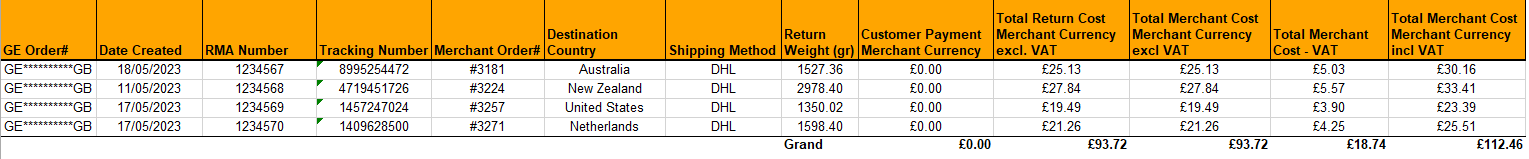

The following figure shows the Returns report:

The following list describes the Returns report elements:

GE Order #: A unique Global-e ID created for each order in the system - for example, GE7733229GB.

Date Created: The date on which the order is created in Global-e's system.

RMA Number: A unique ID number created for each return label - RMA.

Tracking Number: The tracking number for each parcel.

Merchant Order #: Your ID number for the order, generally taken from your platform.

Destination Country: The destination country to which the order is shipped.

Shipping Method: The delivery method used for the return shipment.

Return Weight: The actual weight of the return in kilos or pounds.

Customer Payment Merchant Currency: Return shipping costs paid by the customer - a fixed rate according to configuration.

Total Return Cost Merchant Currency: The total return costs, excluding VAT.

Total Merchant Cost Merchant Currency: The total cost to the Merchant, excluding VAT; this is the difference between the amount paid by the customer and the total

Service Fee

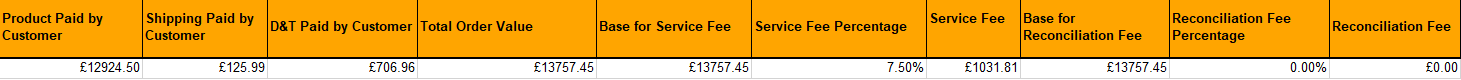

The following figure shows the Service Fee report:

The following list describes the Service Fee report elements:

Product Paid by Customer: The total product paid by the customer at checkout and as reflected in the orders and products tabs totals.

Shipping Paid by Customer: Total shipping paid by the customer as reflected in column L of the reconciliation report.

D&T Paid by Customer: Total D&Ts paid by the customer as reflected in column Q of the reconciliation report.

Total Order Value: The total order value used as the base to calculate the service fee.

Base for Service Fee: The total order value used as the base to calculate the service fee.

Service Fee Percentage: The Percentage from the contract used to calculate the service fee; referred to as the platform fee in the contract.

Service Fee: The service fee based on the percentage listed in the field above, based on the total order value paid by the customer, also listed in the fields above.

Base for Reconciliation Fee: The fee calculation based on the Total Order Value paid by the customer

Reconciliation Fee Percentage: Percentage from the contract used to calculate the payment processing fee.

Reconciliation Fee: Percentage per contract of the base for Reconciliation Fee noted above.